In the fourth quarter of 2025, a clear trend has developed among for-hire fleets as to where they’re placing their pay emphasis for professional truck drivers in the current market: their most-seasoned, longest-tenured drivers.

That’s according to current quarter data from NTI’s National Survey of Driver Wages published this month, which also provides a myriad of other deep insights into what’s happening with professional driver compensation, recruiting and retention incentives, prevalence of per-mile pay ranges, weekly and annual earnings, and much more.

The charts and notes below outline the driver pay trends identified in the latest National Survey of Driver Wages data. To review all compensation trends in depth and to benchmark your company’s pay against select competitors and in the markets you operate, access a subscription to the National Survey of Driver Wages today.

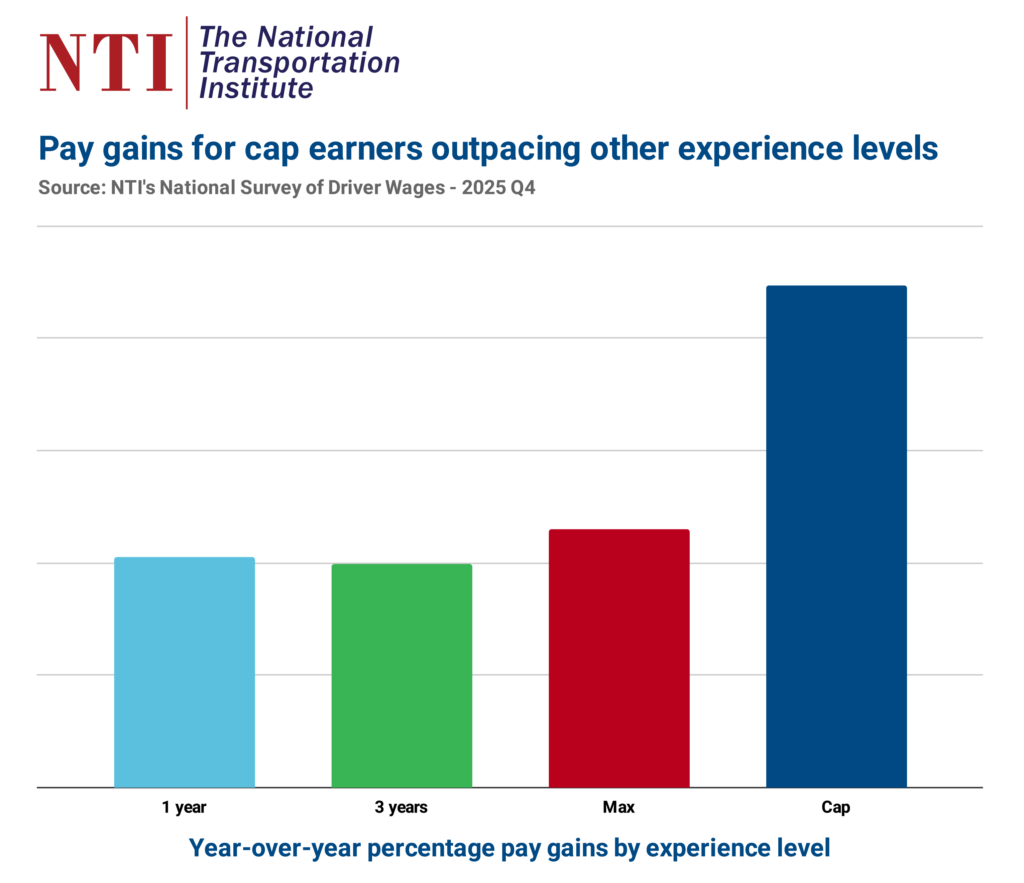

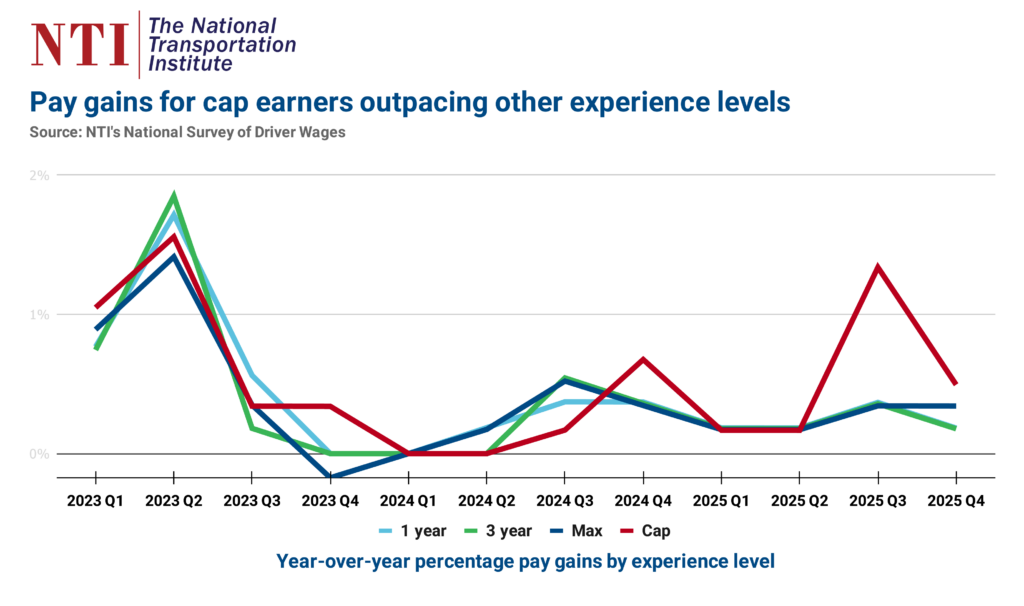

So-called cap earners, drivers with the most experience and longest tenures at their company, are seeing the biggest pay gains this year as carriers strive to hold onto them amid elevated turnover across the industry.

Per-mile base pay for those drivers has climbed upwards of 2 percent year over year in 2025’s fourth quarter — more than double that of drivers with one year of experience, three years of experience, and max experience (the starting pay for drivers with a few years of experience but who haven’t reached cap earner pay due to tenure).

The charts above show both year-over-year gains plus a look at quarter-to-quarter changes for wages by experience level, where you can see the trend developing for cap earners in the back half of 2025.

This trend is a reversal of how base mileage trends unfolded during the freight market boom from late 2020 through mid 2022, when base pay for drivers with a single year of experience climbed at twice the rate of cap earners. Why? Many fleets were desperately trying to hire drivers to keep up with replacement needs and growth demands, and the market demanded wage escalation as those drivers with one year of safe driving experience became highly sought after commodities.

However, in today’s market, with driver churn still elevated, fleets are trying to cling to their most valuable drivers: Their most experienced drivers with longer tenures at their companies, as those are the drivers more in demand today.

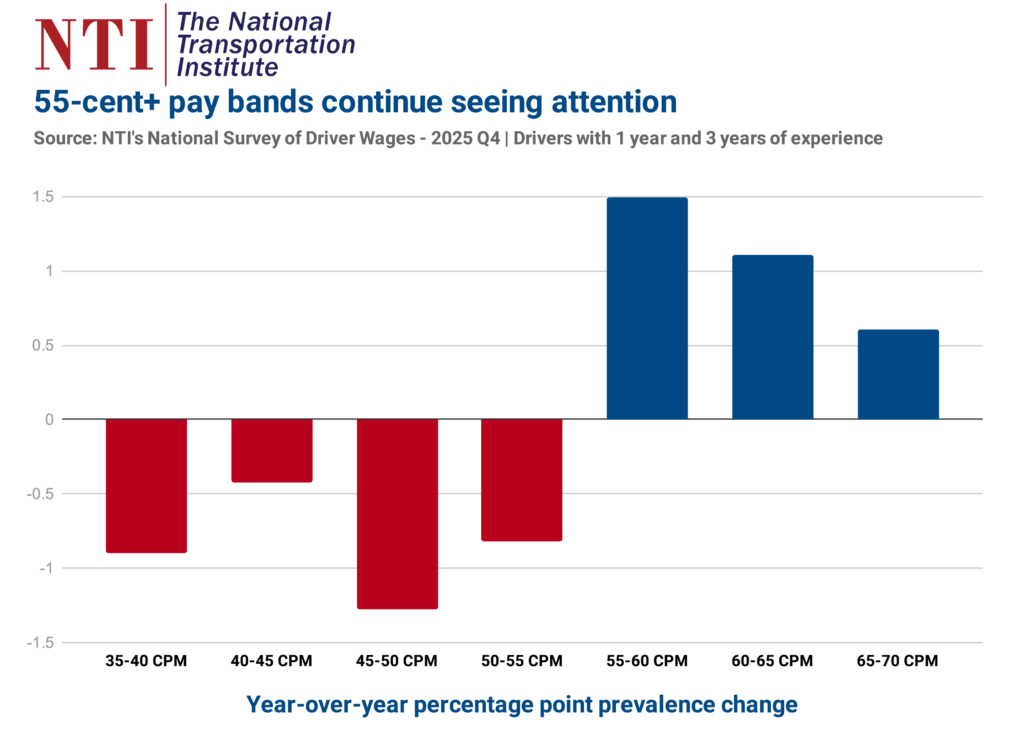

Despite ongoing market setbacks, base pay continues marching into higher tiers

This is a trend we recap nearly every quarter in our data wrap-ups, but it’s one that has become more of a focal point since late last year, when pay momentum broke loose from a period of stagnation in late 2023 and into the first half of 2024: Fleets increasingly are leaving behind lower-end pay ranges and migrating wages up the scale. As the chart above shows, the 55-cent and higher pay ranges are where pay is moving for drivers with 1 year of experience and 3 years of experience, while prevalence among 55-cent and lower are losing prevalence.

2025 was also the year that the 55-60-cent pay bucket overtook the 50-55-cent range as the most prevalent 5-cent pay band for those 1-year and 3-year drivers.

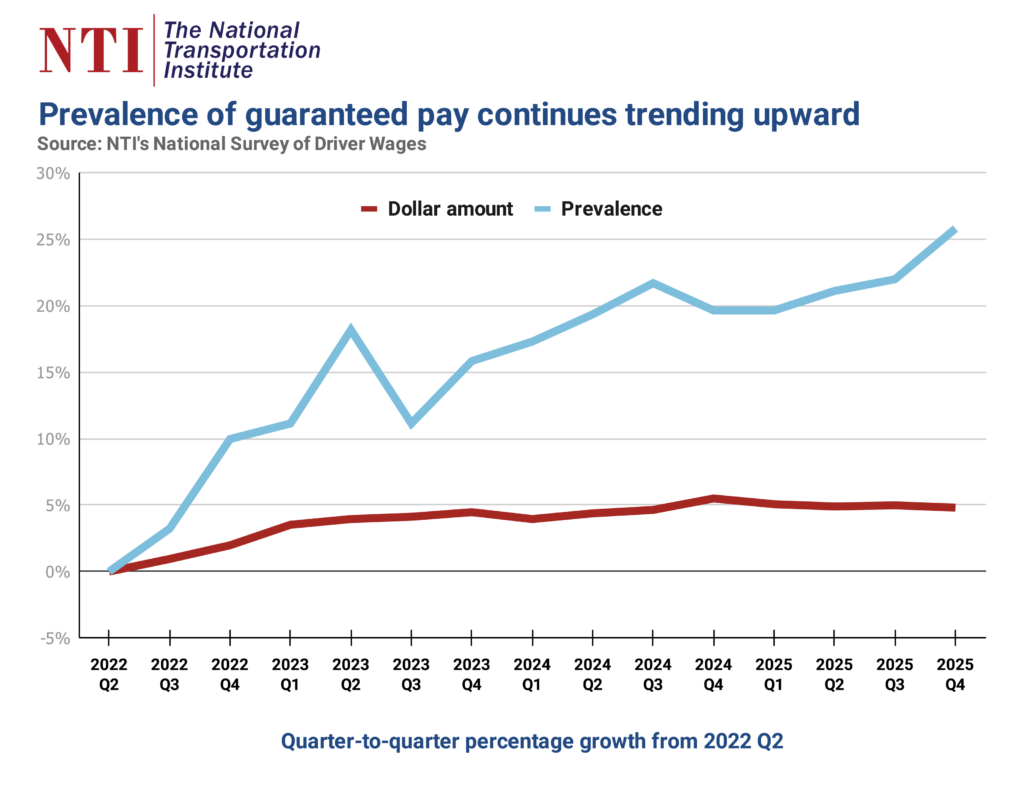

Recruiting incentives mostly hold tight, though guaranteed pay prevalence sees momentum

The dollar amount and prevalence being offered by for-hire fleets for sign-on bonuses have both mostly remained unchanged this year. We explored more on sign-on bonuses earlier this year in the NTI Blog, which you can read here. Likewise, prevalence and dollar amounts for referral bonuses have stayed static, with about 9 in 10 carriers reporting offering a referral incentive. To access dollar amounts for both sign-ons and referrals, subscribe to NTI’s National Survey of Driver Wages.

Prevalence of guaranteed pay programs, however, has seen momentum throughout 2025, as the chart above indicates. That includes a 4 percentage point gain this quarter alone, and growth of over 25% since mid-2022. We explored guaranteed pay and considerations your fleet should make when evaluating implementing this pay structure last month in the NTI Blog. Read it here.

Driver pay hotspots still in motion in 2025

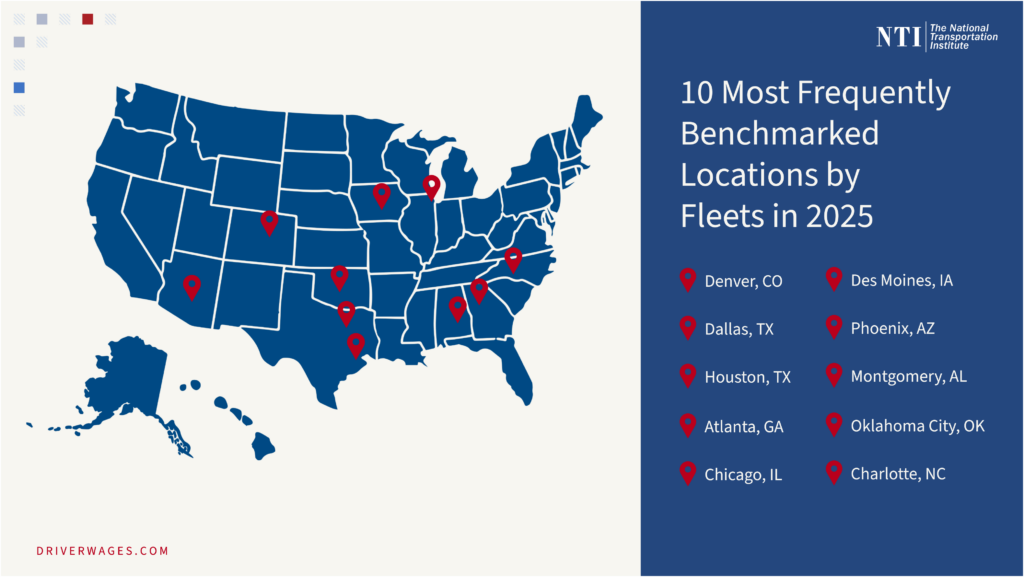

Throughout 2025, unlike years past, the most frequently benchmarked locations across the U.S. have remained a moving target. In 2024, the Top 10 most frequently benchmarked locations list remained somewhat static. However, those locations have continued to shift throughout 2025 as freight flows have altered amid broader economic and policy changes. While the Top 5 locations have remained the same, it’s the next 15 locations that have rotated in and out of the Top 10 list.

Here are the Top 10 locations year to date in 2025, according to NTI’s National City-Centric Driver Pay Survey, which reports mileage, hourly, and W2 pay at more than 800 locations nationwide:

Dropping out of the Top 10 list in recent months are: Pittsburgh, Pennsylvania; San Antonio, Texas; Memphis, Tennessee; and Richmond, Virginia.

Entering the Top 10 were Des Moines, Iowa (a re-entry from 2024); Phoenix, Arizona (a re-entry from earlier this year); Oklahoma City, Oklahoma; and Charlotte, North Carolina (another re-entry from earlier this year).