One year ago, when the calendar flipped from 2024 to 2025, anxiety in trucking about the state of the freight market lingered as a prolonged and harsh downturn entered its fourth calendar year. While hope bubbled entering 2025 that it could be the year fortunes shifted for an industry battling high operational costs and depressed freight rates, the cycle persisted.

Entering 2026, sentiments are the same as a year ago: Cautious optimism that supply and demand dynamics will begin to shift and that freight rates will see some upward trajectory in the year ahead.

However, while hopes for a turn around in 2025 did not materialize, that doesn’t mean the winds of change did not blow in 2025. For the purposes of NTI’s 2025 recap and our focus on professional truck driver pay, 2025’s shifts swirled and coalesced largely around a few key themes: Despite another slog of a year, driver turnover remained elevated, driver supply (and fleet capacity) began exiting the market more briskly in the back half of the year, and trends in driver compensation showed up in NTI data as reactionary to those trends.

Also highlighted by NTI throughout 2025 was a focus on drivers’ experience in their jobs and at their companies as paramount to fighting elevated turnover and improving retention.

Here’s NTI’s 2025 recap of driver pay trends, resources published throughout the year for your fleet to lean on, and insights to understand as we enter 2026:

Still strategically cautious, here are the driver wage trends that shaped 2025

As we covered here in the NTI Blog in our wage trends update in July: In summer of 2024, NTI reported that, along with the summer heat, driver wage momentum (or lack thereof) had thawed, with per-mile pay at for-hire fleets showing the first real movement of that year. A year later, in summer of 2025, wage activity is once again showing some warmth, with per-mile pay growth seeing its most strength since late 2022.

Summer 2025 saw the largest quarter-to-quarter mileage pay gains since the 2022, while year-over-year growth hit its highest point in 18 months. Albeit, those gains were still small compared to the market run-up in 2021 and 2022, but they marked a change in direction nonetheless.

By late 2025, a clear trend had developed among for-hire fleets as to where they’re placing their pay emphasis for professional truck drivers in the current market: their most-seasoned, longest-tenured drivers.

Data from NTI’s National Survey of Driver Wages outlined that pay gains for cap earners, those with the most experience and longest tenures, was doubling those for drivers with less experience and less tenure. You can see those trends develop in these charts published in October.

With driver turnover remaining elevated throughout 2025, fleets’ pay emphasis was on their most valuable drivers and those most in-demand. NTI expects that trend to continue into 2026, based off of the factors outlined below that will influence driver wages in the year ahead.

Other pay trends that developed in 2025

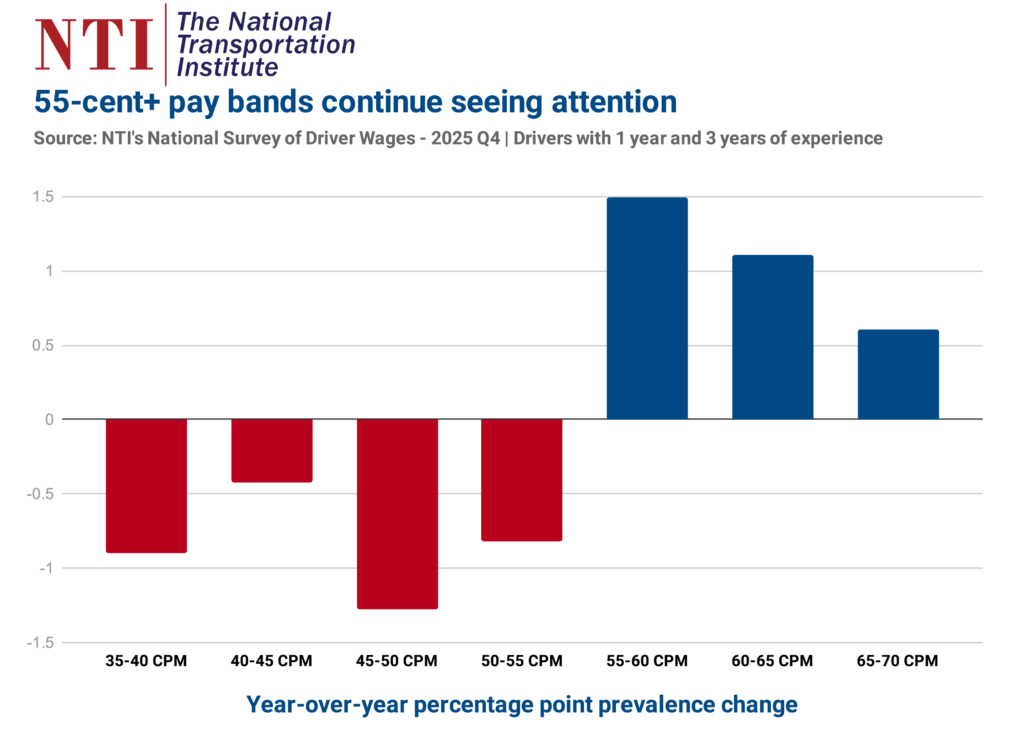

Most common mileage pay range shifts: The 55-60-cent pay bucket in 2025 became the most prevalent 5-cent pay range for drivers with 1 year and 3 years of experience. The 60-65-cent range also saw increased prevalence, while 5-cent pay bands under 55 cents all saw declining prevalence. Looking ahead to 2026, will the 60-65-cent bucket become the most prevalent? Or will the 55-60-cent range remain the most prevalent?

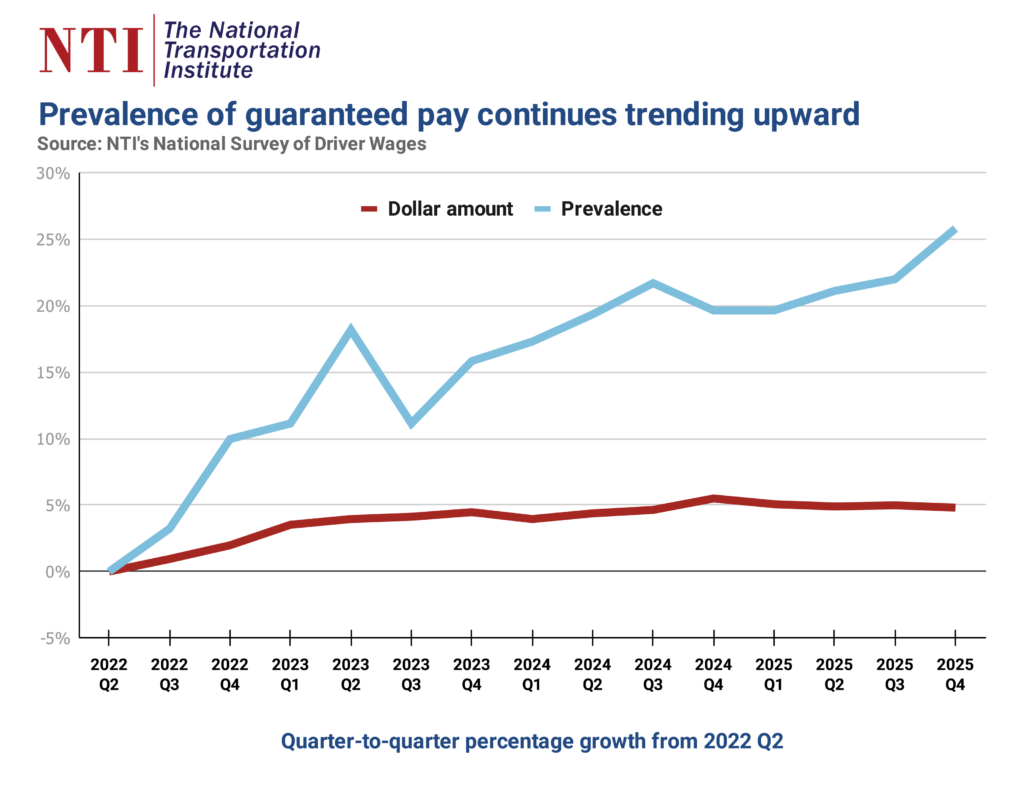

What happened with guaranteed pay: Prevalence of guaranteed pay programs jumped throughout 2025, even with dollar amounts for such pay programs remaining flat. Prevalence of guaranteed pay programs has grown over 25% since mid 2022. Read more about that trend here.

Sign-on bonuses climb for the first time in 3 years: For another prominent incentive, sign-on bonuses, prevalence of fleets offering these bonuses held flat at around 70%. Dollar amounts, however, a signal of recruiting tightness, did inch up for the first time in three years in the back half of 2025. We explored that small change here, along with other factors influencing sign-on bonuses and potential alternatives to this highly prevalent incentive.

Location-based pay benchmarking continues becoming predominant and vital to decision making: As noted here by NTI’s Leah Shaver, 10 years ago, a trucking job was a trucking job was a trucking job. Meaning driver wages and benchmarking were generally much simpled: What are your peers paying on a per-mile rate and what decisions do you need to make to position your pay as needed? That dynamic has shifted dramatically in the past decade, especially over the past half decade. Job roles have changed and expanded. Fleets began moving toward location-based hiring models and by driver job type. A greater emphasis has been placed on

Those were all themes that continue to become calcified in the industry at large, in the ways fleets access NTI’s pay benchmarking data, and in how fleets recruit and retain their workforce, and will certainly remain an important ongoing trend in 2026.

Private and dedicated fleets up continue to pursue — and pay’s a pivotal component: Much of the shifts in location-based and job-focused pay packages have been sparked and driven by private and dedicated fleets, who over the past two years have also been putting a strong emphasis on growing their fleets and recruiting and retaining the drivers they need to do so.

Private and dedicated fleets have not only been emphasizing needed wage changes to attract new drivers and retain existing ones, they have been taking highly analytical and granular approaches to benchmarking and adjusting their total compensation packages, as well as simplifying their pay models to promote transparency and greater understanding among drivers of what they will earn on the job.

What will impact pay in 2026?

As we look ahead at the four critical factors that influence driver pay perennially, the focus entering 2026 is heavily on what’s happening with driver supply, as noted in NTI’s latest Driver Supply Update published in November.

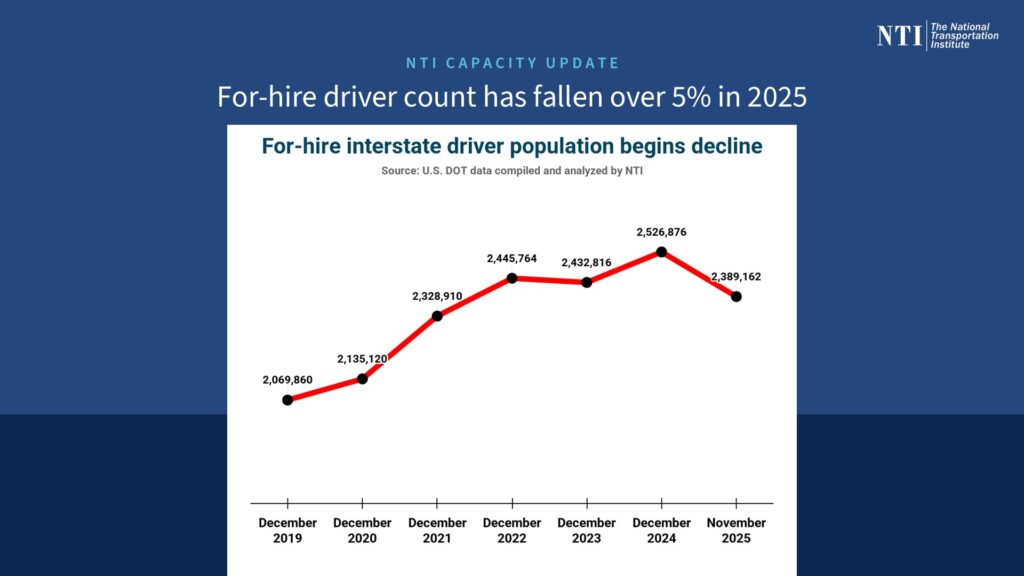

While regulatory shifts around non-domiciled CDLs and English-Language Proficiency have been peeling away available workforce from trucking, industry capacity was already shrinking, including fleet exits and a noteworthy drop in the for-hire driver population in 2025 (over 5%):

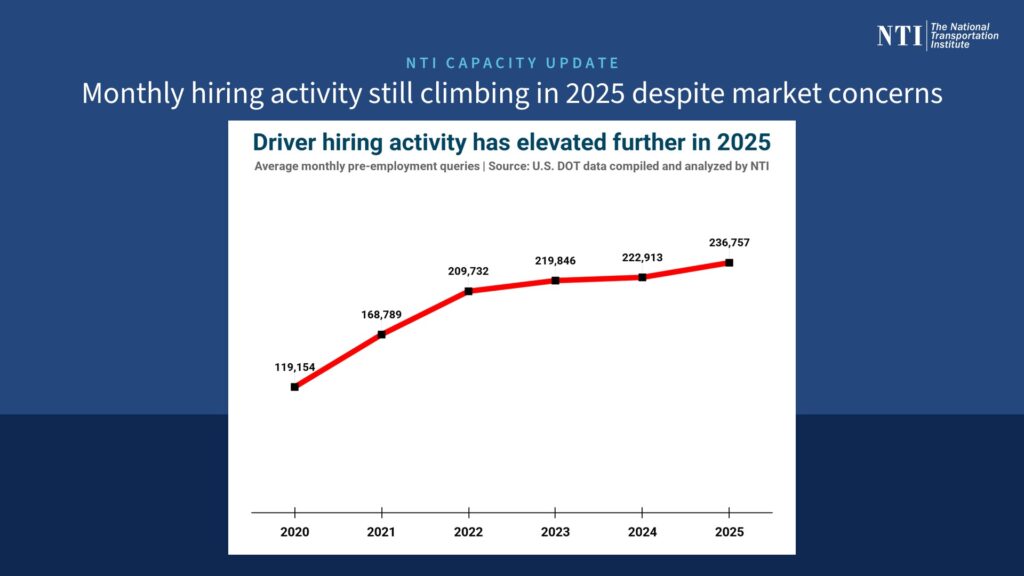

At the same time, driver hiring numbers jumped in 2025:

Those two critical trends — shrinking workforce and turnover-driven hiring expansion — will be the predominant factor influencing any driver pay movement to start the year. With industry capacity already in a downward trend and exiting more quickly in the last months of 2025, any growth in freight demand in 2026 would put upward pressure on freight rates and, thus, driver wages.

In this article published in HDT in August, we outlined the state of the freight market and how it’s influencing driver wages, as well as the factors that could lead to increased freight rates, or those that could continue to beset them. Also, stay tuned for our annual Driver Market Forecast for 2026, which will be published in February and further outline NTI’s outlook for 2026 and our forecast for driver wage changes.

An eye on diesel tech pay in 2026: While trucking’s focus on talent acquisition and retention historically has largely revolved around professional truck drivers, that’s not the only shortage of skilled workers facing for-hire carriers and private fleets. Trucking also is contending with a dearth of professional diesel technicians, which has only grown more severe in the turbulent labor market over the past five years. Interest in technician pay benchmarking has swelled at The National Transportation Institute in recent years, including survey demand doubling in recent years for technician pay reports as the challenge to hire and retain diesel technicians continues to become more difficult for trucking fleets of all types. We also expect that trend to become even more defined in 2026.

NTI turns 30!

2025 marked a significant milestone for The National Transportation Institute: Founded in 1995, NTI this year celebrated 30 years of growth, innovation, dedication, and service to the greatest industry in America and the hard-working professionals across trucking who keep society moving and thriving.

As the industry’s sole authority on driver pay data and benchmarking since 1995, our team is immensely proud and grateful to support your fleet and your goals for three decades running.

Read more about NTI’s 30th anniversary here.

NTI’s Leah Shaver recognized for industry influence

NTI’s Leah Shaver in October was named one of four finalists for the 2025 Influential Woman in Trucking Award by the Women In Trucking Association. The award honors female leaders who are shaping the future of trucking and inspiring others through innovation, leadership, and a commitment to advancing women in the industry.

NTI’s Leah Shaver in October was named one of four finalists for the 2025 Influential Woman in Trucking Award by the Women In Trucking Association. The award honors female leaders who are shaping the future of trucking and inspiring others through innovation, leadership, and a commitment to advancing women in the industry.

Leah was recognized for the multi-faceted ways she influences decisions across the industry, from the driver level to critical decisions made by executives at trucking companies and private fleets, including shaping strategies around driver compensation policies, career paths, workforce development, and building pathways for more women and younger generations to enter trucking.

Leah joined her three fellow finalists on stage at the Women In Trucking Accelerate! Conference & Expo in Dallas, Texas, where the four finalists held a panel discussion about how fleets and the industry can grow the number of women entering trucking and develop paths for them to enter leadership roles, among other vital topics.

Read Leah’s recap of her takeaways from the conference here. She also shared this article in FleetOwner in December focused on how trucking and fleets can create opportunities and career paths for working parents, from drivers to fleet leadership.

That wasn’t the only time Leah took the stage this year to share her insights with industry leaders. She gave this year’s keynote address at the National Private Truck Council in May in Orlando, highlighting the industry’s talent tug-of-war for available drivers and technicians.

She also shared the stage in November with former FMCSA Administrator Robin Hutcheson and professor Alison Conway, where the trio discussed how a dramatically shifting logistics landscape has altered fleet operations and drivers’ experience. Read a recap of the key takeaways from those conferences here and here.

Lastly, in December, NTI 🎁 *unwrapped* the driver experience and lessons learned in 2025 that can be put to use in 2026:

Drivers at the center of everything we do: It’s a real business strategy with major ROI

Five lessons from drivers that can bolster your fleet’s retention

In a new world of trucking, we have to reframe drivers’ experiences beyond DCs and docks

Breakdown layovers: Drivers’ problem or company responsibility?

Where are we going to find the next generation of truckers?

**