While driver compensation at for-hire motor carriers has been coming back to life of late, driver compensation data for private fleets — those who run trucking fleets hauling primarily their own companies’ freight — tells a different story: they have been highly active in benchmarking and adjusting their pay packages amid a push to fortify their transportation networks and recruit and retain the drivers they need not only for today, but for the next freight cycle, too.

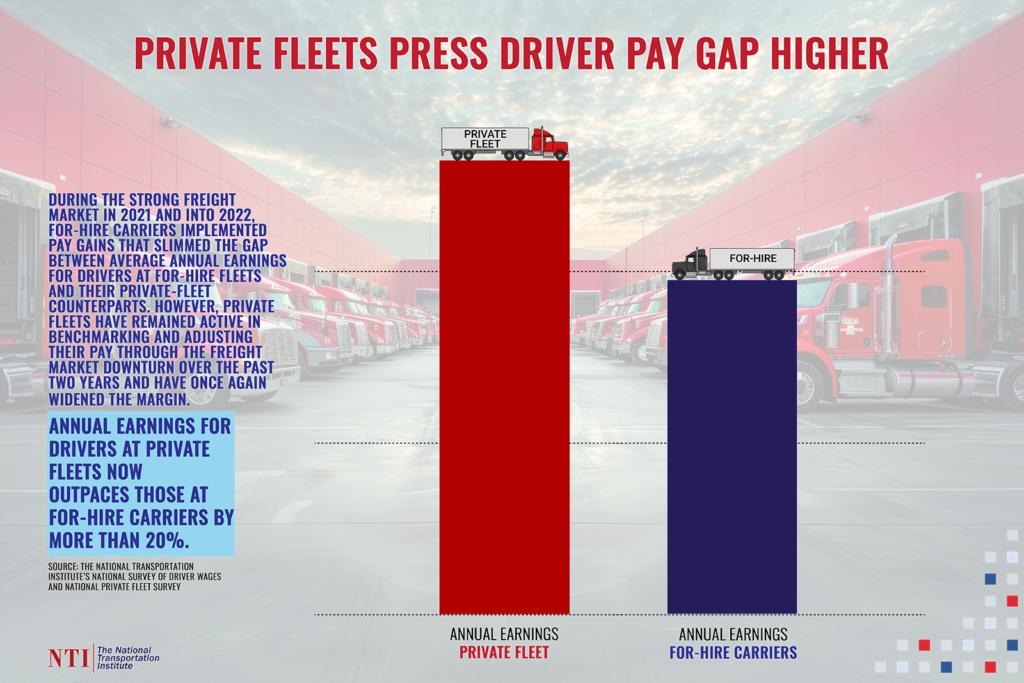

Private fleets have long maintained a driver pay gap in relation to their for-hire fleet counterparts, with private fleets paying drivers about 20% more, comparing average annual earnings between the two. That gap shrank some with the surging freight market in 2021 and early 2022, when for-hire fleets raised pay at a record-setting pace to try to attract and retain drivers to meet their workforce needs.

However, over the past two-plus years, private fleets have once again pushed the spread between their pay and for-hire fleets’ to where it has historically been, and even higher depending on the location, market need, job type, and other factors.

Private fleets have been actively benchmarking and adjusting their driver compensation packages with a highly granular approach to all components of their pay packages, from base hourly and mileage pay to annual earnings and the dozens of other that make up their total offerings. While pay gains at private fleets aren’t quite as robust as they were during the booming recovery period from late 2020 through early 2022, they do persist at greater clip than increases at for-hire fleets. Private fleet pay has climbed this year between 2% and 5% at the market (location) level, and sometimes even more, depending on factors like driver supply and demand, hiring goals, and how fleets choose to structure their pay within their markets based on benchmarking data from NTI.

Active and detailed benchmarking has been particularly prominent among fleets hiring for jobs in the narrower parts of the hiring funnel, such as those with more stringent hiring qualifications, labor-intensive positions, tanker jobs, teams, and more — think energy companies and fuel haulers, grocers and food suppliers, construction materials distributors, and retailers. Regional jobs, in particular, have seen a flurry of pay adjustment activity, with the National Private Fleet Survey showing that average annual W2 pay for regional drivers has climbed nearly 25% since 2021.

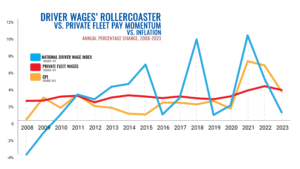

While wages at for-hire carriers have existed on a rollercoaster, private fleets have emphasized consistent, steady growth. Charting NTI’s National Driver Wage Index, which tracks movement of base pay in the for-hire segment, and data from NTI’s National Private Fleet Survey, you can see the yo-yo effect of market impacts on for-hire wages over the years, particularly the past few cycles, compared to the consistency of private fleets’ approach to driver wages:

Private fleets’ granular approach to compensation benchmarking goes well beyond base pay and annual earnings, too. In consultations with private fleets throughout the year, NTI’s team has fielded questions about clothing and boots stipends, best practices around meal breaks and payments, transition pay, layover pay, guaranteed pay, referral programs, and much more.

Lastly, a trend that has picked up steam over the past two years among private fleets: Analyzing and transitioning pay structures away from mileage pay and to hourly models as a means to simplify drivers’ pay packages, making them easier for drivers to understand, and to make it simpler and easier for companies to incorporate overtime pay (which has a high prevalence among private fleets) and to administer payroll.