Current data from NTI’s National Survey of Driver Wages reveals fleets have been active in adjusting incentives paid to professional drivers that promote cost savings while also giving drivers the opportunity to boost their paychecks absent the aggressive base pay increases seen from late 2020 through the middle of 2022.

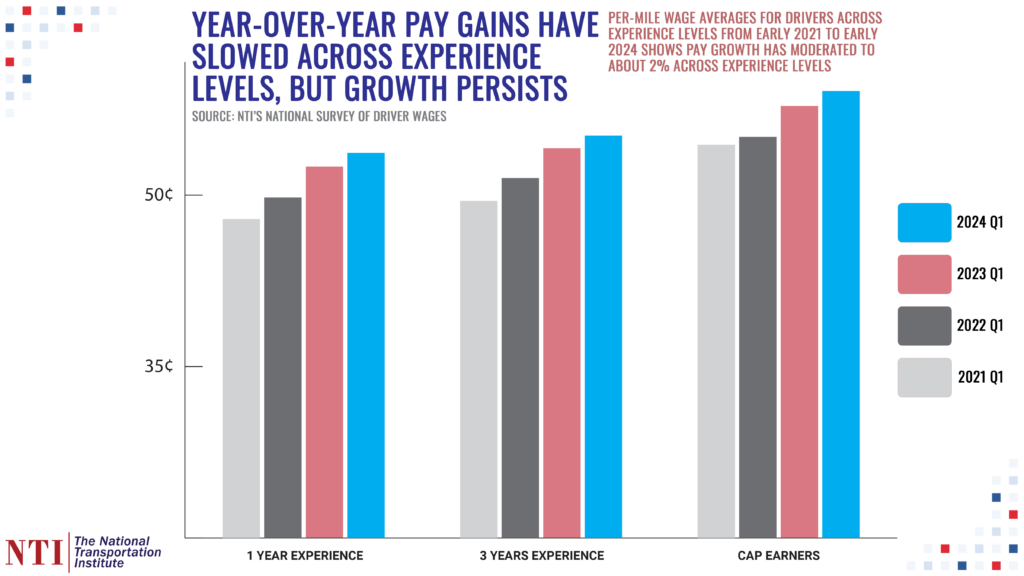

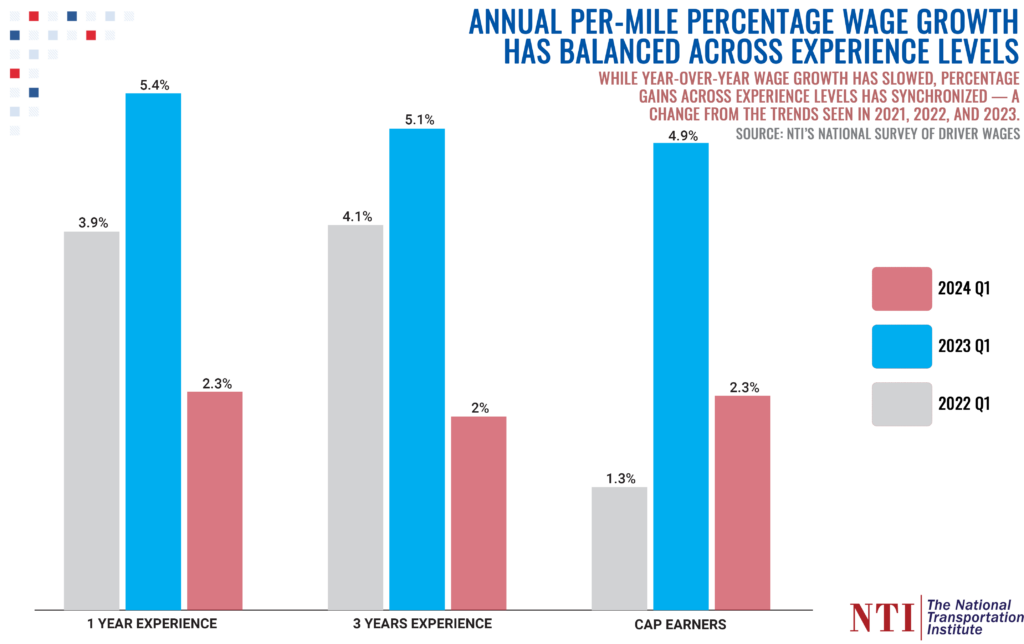

While base pay gains have moderated and stabilized, current data published this month in NTI’s National Survey of Driver Wages shows year-over-year changes do persist for drivers’ base hourly and mileage pay — evident by the continued progression of prevalent 5-cent pay ranges up the pay scale.

Here are the key trends and takeaways from current driver wages data we’re watching:

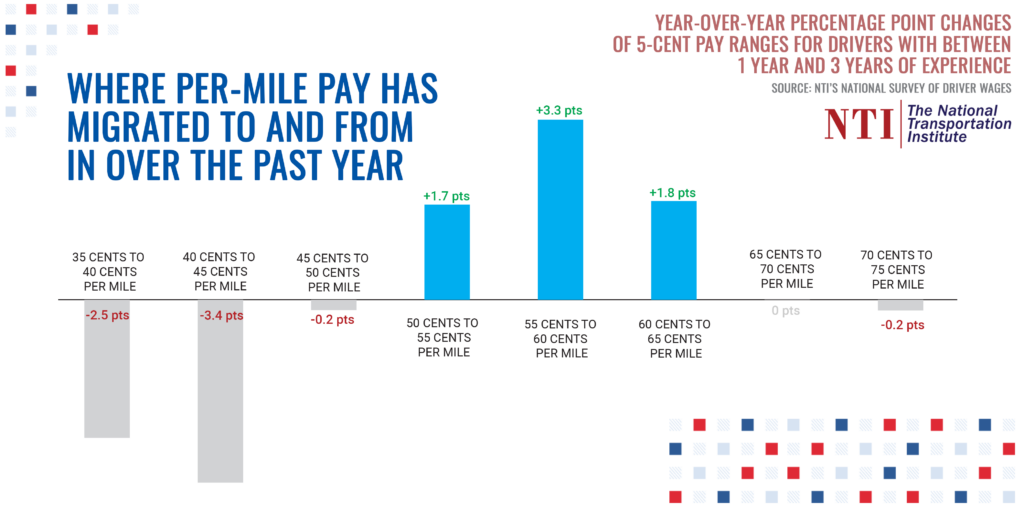

Mileage pay continues to move up the pay scale as pay raises remain moderate

Since the first months of 2023, base mileage pay for drivers with 1 year of experience and three years of experience continues to shift into the 50-65-cent tiers, with the 55-60-cent bucket seeing the biggest percentage point gain from the same time a year ago. The attention on those buckets corresponds with pay prevalence shifting away from the 35-40-cent range and the 40-45-cent bucket, in particular:

Here’s a look at how aggregate mileage pay progressed across driver experience levels over the past year, as well as the percentage pay gains for each experience category:

Fleets emphasize incentives that promote cost savings and give drivers an avenue to grow their paychecks

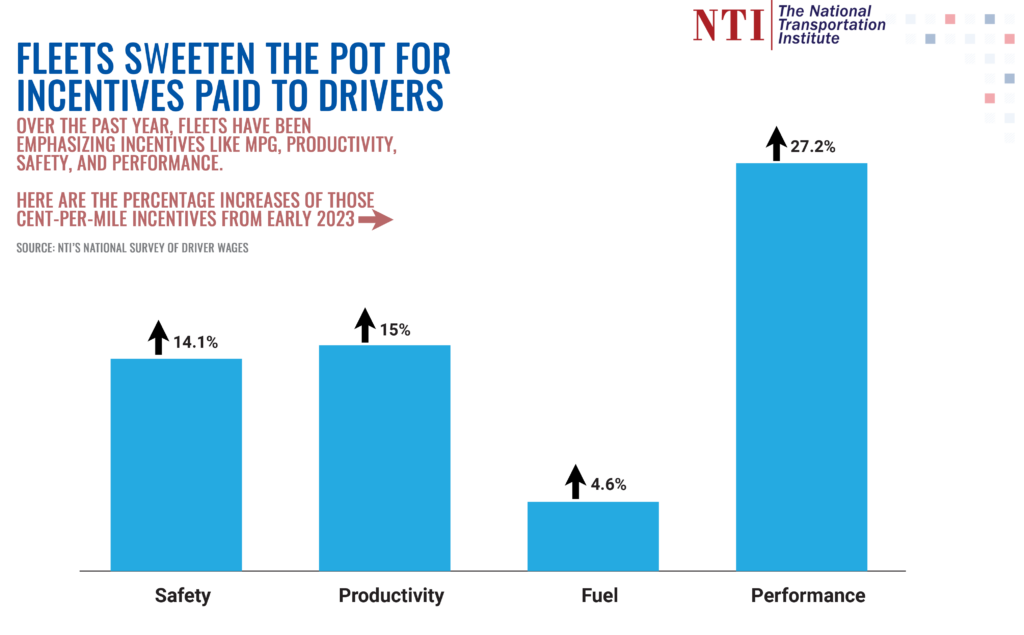

Comparing driver compensation attributes in 2024’s first months to the same time a year ago, there’s been a clear trend of for-hire fleets sweetening the pot for drivers when it comes to incentives like fuel mileage targets, productivity, safety, and performance.

The chart below shows the cent-per-mile percentage gains of those incentives, highlighting the notable acceleration over the past year:

Read NTI’s 6 Driver Pay Strategies to Excel in a Slower Freight Market

Also, read this resource from NTI published last year: Out-of-network fuel buys can cost your fleet big bucks. Here’s how to incentivize and educate drivers to pad their paychecks and your fleet’s bottom line

Data for sign-on bonuses, referral bonuses, and guaranteed pay shows sustained recruiting momentum

Even though driver hiring demand has eased over the past 18 months, hiring activity still remains robust. Throughout 2023, driver hiring volume remained higher than in 2022 and 2021, according to pre-employment queries to the U.S. DOT’s CDL Drug & Alcohol Clearinghouse data. The prevalence of fleets offering sign-on bonuses and referral bonuses from NTI’s National Survey of Driver Wages also signals sustained recruiting momentum.

The prevalence of sign-on bonuses and the dollar amount of those bonuses in the first months of 2024 are unchanged from the final months of 2023. Comparing year over year, prevalence and dollar amount of sign-on bonuses are down slightly — a trend that developed throughout 2023.

However, prevalence of referral bonuses and guaranteed pay are both up year over year and from the final months of 2023. Dollar amount for both of those incentives also grew from the same time a year ago.