Through the first months of 2025, pay for professional drivers at for-hire fleets is still mostly in a holding pattern — a neutral reading given uncertainty clanging around the freight market amid broader economic shifts.

While some movement bubbled with driver pay among for-hire fleets in the later months of 2024, compensation activity has been in a pattern of small incremental gains through the first months of 2025. Year-over-year comparisons continue to tick higher, with muted gains in the first months of 2025 building on a brief tailwind in momentum in the back half of 2024.

There were wisps of gains in driver wages during pockets of 2023. But last year saw the industry contending with the late stages of a long and tiresome freight recession that had most fleets delaying any meaningful pay changes while waiting out the market’s fortunes.

Beginning in the late summer and continuing through the fall and winter, though, the holding pattern broke, and data from NTI surveys of motor carriers shows driver pay has entered what appears to be a new season as capacity shakes out of the market and as both spot and contract freight markets recalibrate.

The state of driver pay at for-hire motor carriers in the first weeks of spring of 2025 seems to be like a lawn mower’s first crank of the season — a little slow to start, and the pull cord likely needs to be yanked a few extra times.

The season has changed, nonetheless, from the correction cycle that existed from mid 2022 through the back half of 2024. What shape this new cycle takes, however, remains a bit murky.

Here’s what survey data from NTI’s National Survey of Driver Wages shows for driver pay movement in early spring 2025:

Base mileage pay growth climbs year-over-year for third straight quarter

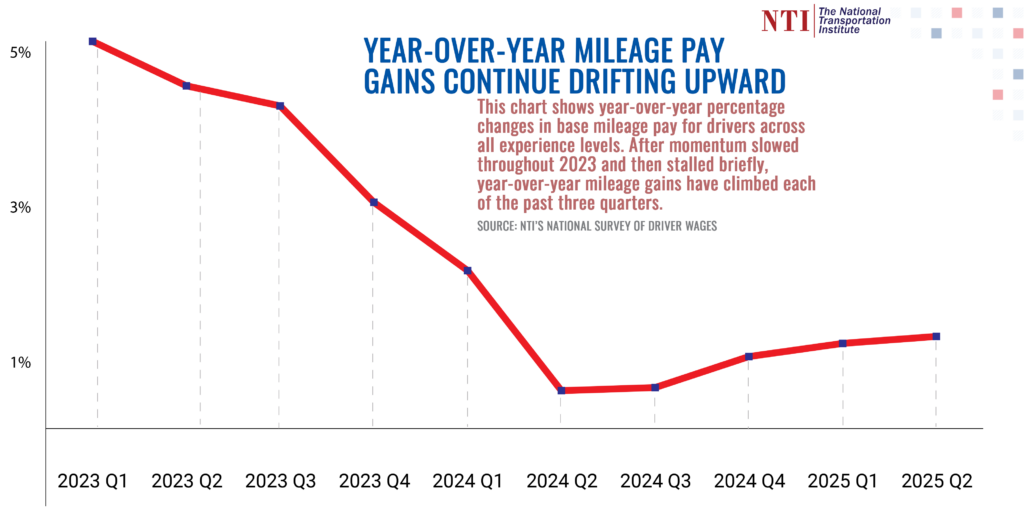

While pay was still growing year-over-year, the rate of that growth had slowed for five consecutive quarters starting in early 2023 and then stalled in the middle of 2024 — meaning fleets doled out smaller and smaller pay changes during that time frame.

The growth rate in year-over-year mileage pay comparisons has now resumed for three consecutive quarters, signaling that pay momentum has resumed, albeit slightly and building off of the brief upticks from late 2024:

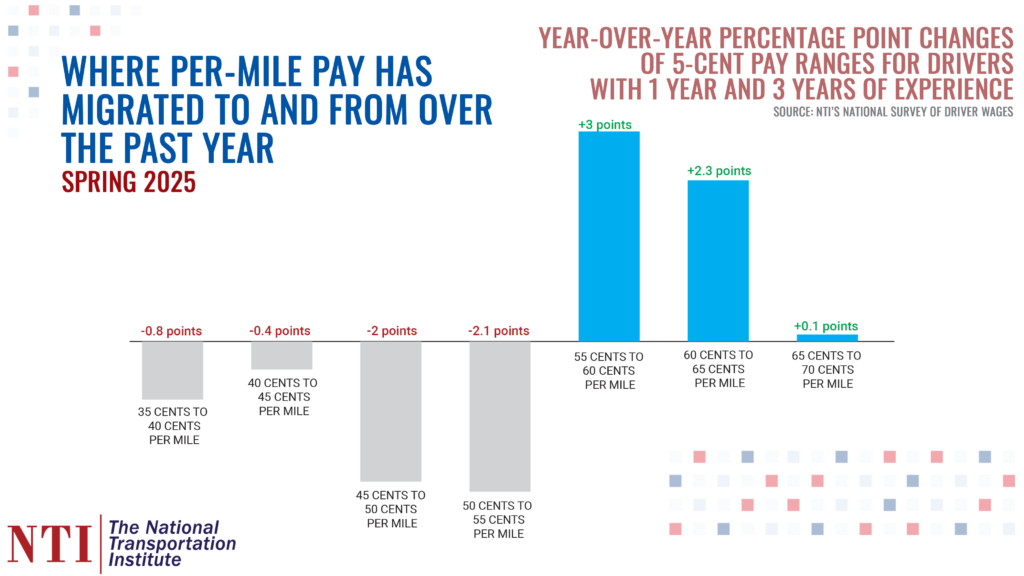

Though growth remains restrained, as the chart below shows, for drivers with 1 year of experience and 3 years of experience, carriers continue to nudge their pay packages higher, with the 45-55-cent pay ranges seeing less prevalence, and 55-65-cent ranges seeing higher prevalence:

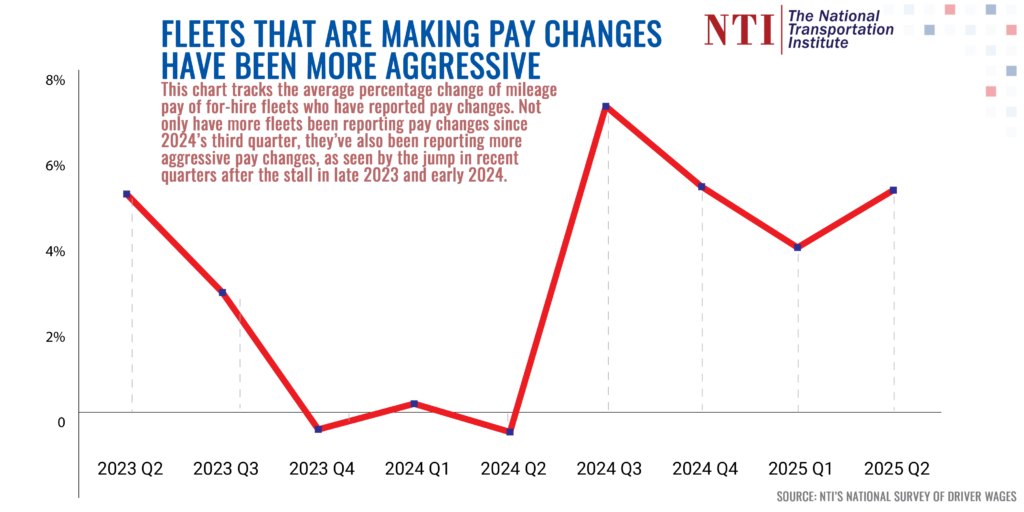

Fleets who are reporting pay changes are getting more aggressive

As the chart below shows, of the fleets who report pay changes in the National Survey of Driver Wages, the rate of those pay changes has jumped. This chart also shows the stagnant period at the end of 2023 and into early 2024 — and then a shift as pay changes picked up:

Sign-on bonuses see first quarter-over-quarter jump in over two years

The dollar amount that fleets were offering drivers in sign-on bonuses peaked in the first quarter of 2023 at an average of over $4,000. Prevalence also peaked, with nearly 75% of carriers reporting offering a sign-on bonus to new drivers. Prevalence of sign-on bonuses has drifted slightly, but has been holding flat at around 70% over the past two years. The dollar amount of sign-on bonuses, though, had been gliding downward, shaving off $50-100 a quarter — until late 2024, when sign-on amounts fell by a few hundred dollars.

For the first time since late 2022 and early 2023, the dollar amount fleets are offering drivers for sign-on bonuses climbed in the second quarter of 2025 from the quarter prior.

Referral bonuses — incentives offered to drivers for referring a driver candidate to apply for a job and who is hired at their company — maintain a very high prevalence, with nearly 90% of fleets reporting offering a referral bonus. Dollar amounts for referrals have remained steady at just under $2,000.

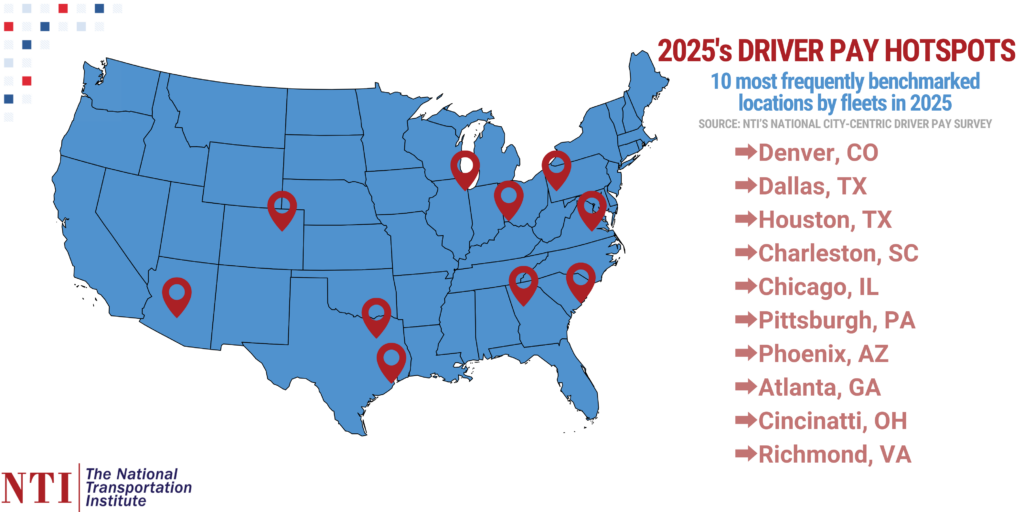

A shift in driver pay hotspots

Tracking the most frequently benchmarked locations in NTI’s National City-Centric Driver Pay Survey, which reports mileage, hourly, and W2 pay at more than 800 locations nationwide, a shift has occurred in 2025 as to which locations are in demand.

Columbus, Ohio, one of the most actively benchmarked locations in 2024, has slipped out of the top 10, as has Indianapolis. Both locations stand at intersections of major midwest corridors. Those two midwestern hubs so far in 2025 have been replaced by nearby Cincinnati, Ohio, and a little farther east, Pittsburgh, Pennsylvania.

Savannah has been bumped by Charleston, another major East Coast port city a little north of Savannah.

Holding steady in the top 10 most frequently benchmarked locations are major Texas hubs Dallas and Houston, as well as the most evaluated market in recent years and one of the toughest hiring and retention markets — Denver, Colorado.

Demand for regional drivers in Dallas has spiked over the past half decade, and wages for that segment have reacted to that demand. Meanwhile, Denver has some of the stronger annual earnings compared to national averages in the four key segments tracked in NTI’s National City-Centric Driver Pay survey. As an example, pay for OTR drivers is 4% stronger than the national average, while pay for dedicated fleet drivers is nearly 6% higher.

Entering the top 10 in 2025 after an absence in 2024 are Chicago, Illinois, and its suburbs, and Phoenix, Arizona. Just missing the cut in 2024, Atlanta, Georgia, has now also returned to the top 10 most actively benchmarked markets. Lastly, and seemingly tied into interest in East Coast corridors and port operations so far in 2025, is Richmond, Virginia.

Falling out of the top 10 through the first months in 2025 are Ontario, Canada; Minneapolis, Minnesota; Kansas City, Missouri; Detroit, Michigan; and Des Moines, Iowa, though these locations remain actively benchmarked through April 2025.

➡️ Want to gain access to NTI’s authoritative benchmarking data to steer your fleet’s strategies and success in driver compensation, recruiting, and retention? Contact our team of experts today to learn more.