➡️ Looking for more driver pay strategies to help promote fleet profitability in the current freight environment? Read NTI’s 6 Driver Pay Strategies to Excel in a Slower Freight Market. ⬅️

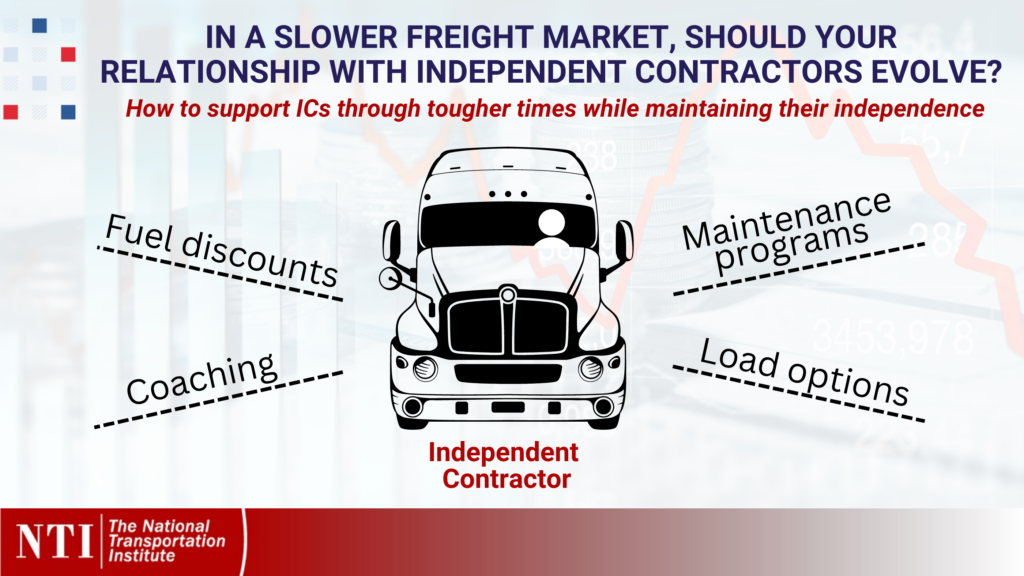

In slower freight markets where costs climb and rates dip, you and other colleagues at your fleet likely feel the need to find ways to support your company’s independent contractors, who are striving to stay afloat as they weather the downturn.

However, your fleet must remain vigilant in ensuring you’re not crossing boundaries that open you up to claims that you’re misclassifying employees or wading into murky legal areas. Carriers working with independent contractors can and should offer resources and support for those ICs, but they must be mindful of the boundaries that come with those relationships, says Doug Grawe, an attorney and owner and CEO of The Grawe Group, a transportation-focused law firm.

Primarily, those boundaries center around control over the worker in question.

“Whether it’s an agency or a court, in determinations about IC status, they’re going to be looking at how much control you assert over that worker and at what decisions the contractor makes that lead to their profit and loss,” says Grawe.

NTI recently talked with Grawe about the pitfalls fleets should avoid when working with ICs and how to properly support your contracted drivers through the current freight market while also maintaining their independence. That includes when both parties want to see the relationship transition into an employer-employee relationship. Here’s his advice:

Avoid eliminating their risk of failure

While it can be tough to watch your independent contractors scrape by or even go under, the risk of failure is one of the core elements that makes them an independent contractor, says Grawe. “Small business owners choose to go into business for lots of different reasons. There’s a risk that things could go really well — financial opportunities, flexibility, the ability to earn more than you could as an employee. But you can’t have the risk of success without the risk of failure,” he says. “So while it’s perfectly OK to be a safe harbor for your independent contractors, it can’t be so safe that you’re guaranteeing there’s no downside.”

✅ What’s OK: Providing ICs access to discount programs for expenses like fuel, tires, insurance, and maintenance and repairs, or even offering bonuses for productivity or other metrics that could help offset expenses. Also, while it might be tough in the current market, make sure you’re working with shippers to negotiate rates that can cover costs and help your ICs generate revenue and profit.

❌ What to steer clear of: Guaranteed pay minimums and covering costs built into the IC business model, such as fuel, equipment maintenance and repairs, insurance, truck payments, and other expenses. “In my opinion, a simpler pay model is better than complicated pay, but you can get a little bit creative in ways that help your independent contractors. I can get on board with that. You can be a safe harbor by providing resources, but by providing guarantees, you’re eliminating their risks. And in the eyes of those making IC determinations, that would likely cross a line.”

Educate, don’t dictate

✅ What’s OK: Coaching your independent contractors on load selection, fuel buying programs, cost cutting, vendor selection and management, or any other aspect of running a successful small trucking business. “If you’re a 200-truck trucking company, and 100 of those are independent contractors, over 10 or 20 years, you could easily have worked with 500 or even 1,000 independent contractors. You may not realize it, but you’ve learned an awful lot about how to be successful as an owner-operator. You’ve seen the ones that make lots of money, that are happy with their work-life balance. And you’ve seen ones that have struggled and lost their trucks,” says Grawe.

“You can share that knowledge with your ICs,” he says. “You can send them information on maintenance and repair tips. You can share ways they can be smarter in their load choices, companies that can help them manage their accounting, or the knowledge you have about what it takes to be good at fuel mileage and fuel purchasing.”

❌ What to steer clear of: Requiring contractors to attend training or classes, or requiring them to use your fuel program, your preferred maintenance and repair facilities, or the vendors you select. Doing so “takes away control and freedom of how they run their business,” says Grawe. Instead, he says, make classes and training resources available, but don’t make them mandatory. Likewise, don’t make what’s being taught mandatory. Contractors must have the authority to make their own business decisions, says Grawe, whether those lead to success or failure.

Allow freedom for load choices

✅ What’s OK: Helping contractors choose better loads that can lead to their success, offering education on how loads drive revenue and profitability, and even being hands-on with guiding contractors on what loads will help them generate the most profit. “If a contractor is struggling, it’s perfectly OK to say, ‘hey, do me a favor, and take the loads I suggest for the next two weeks and see what it looks like financially. You’re expressing frustration about your finances, but you’re turning a lot of stuff down. If you accept the loads I suggest for two weeks, let’s have another call and see how you’re doing.’ That you can do,” says Grawe.

❌ What to steer clear of: “You can’t say, ‘you can’t turn this load down or I’m cancelling our contract.’ That is exercising control over them. Your contracts must retain the freedom to do what they want, and a major part of that is their decisions on what loads they choose to accept or not accept.”

Treat them like new hires if they become an employee

A contractor may have been leased to your fleet for 10 years, but when both parties agree to transition the relationship into an employer-employee structure, there are several considerations and guidelines to heed, says Grawe. “There’s no harm in making that transition with someone. You can do it. But first of all understand why they’re doing it and what they’re looking for out of it. For example, if they say, ‘Well, I’m getting older and I need better health benefits,’ but you don’t want to put them on your benefits because your expenses would go up — you can’t do that. That’s illegal and it’s discrimination. So you can’t consider things like that.”

✅ What’s OK: Hiring them as a driver. It’s perfectly acceptable to end your relationship with a driver as an IC and hire them as an employee driver. “But make sure you do the hiring paperwork. There needs to be an employee application in that driver’s file, for example,” says Grawe. “Also, make it clear to them that the relationship will change, too. They can’t just transition from an IC to an employee to get health insurance but nothing else changes. Their pay, their schedule, the control you exert over their loads — make sure you’re both on the same page. Let them know everything is going to be different.”

❌ What to steer clear of: Treating the IC’s tenure at your fleet as, well, tenure. For the purposes of this new arrangement, the driver should be treated just like a new hire, from paperwork and onboarding training to tenure-based benefits, such as PTO accrual and health coverage start dates. After all, they have not been an employee of your company, and you don’t want to treat them as if they have. Grawe says this could be grounds for a misclassification claim. “If you treat it like it’s not a big deal and nothing changes, you’re feeding the argument that they were an employee all along, and you don’t want that.”

Keep an eye on California (and other state laws)

California has been a hotbed of legal activity related to driver classification. In 2019, the state voted to enact a law that effectively prohibited trucking companies from using owner-operators and independent contractors to haul freight. Trucking groups have sued to exempt trucking from the law, but federal appellate courts have allowed the law to remain in effect while the litigation against it unfolds. In the meantime, Grawe says carriers must be keenly aware of the AB 5 statutes and work with their legal counsel to determine the right course of action.

For example, he says, if California makes up a significant part of your business and you regularly run in and out of California, or if you have dedicated operations working California routes consistently, the law likely could impact you, so you need to work with your legal team and other advisors to determine the right course of action. Likewise, if you have employees and independent contractors based in California, the law likely also impacts your fleet.

If you do little work in California, or maybe the occasional brokered load into or out of the state, “you need to make a few considerations but likely not any major changes” to what you’re doing, says Grawe.

However, there’s a large grey area in between, and fleets with any operations in California or who have drivers based in California need to consult their advisors to determine how to proceed.

We explored in-depth how fleets can navigate AB 5 in California in a conversation last year with Grawe. Read the full post here.