In summer of 2024, NTI reported that, along with the summer heat, driver wage momentum (or lack thereof) had thawed, with per-mile pay at for-hire fleets showing the first real movement of that year.

A year later, in summer of 2025, wage activity is once again showing some warmth, with per-mile pay growth seeing its most strength since late 2022. The freight recession that began then sent pay momentum into a years-long downward trend. That downward trend ended last summer, and per-mile wage growth at for-hire trucking companies has been steadily climbing since, according to The National Transportation Institute’s National Survey of Driver Wages.

The charts and notes below outline the driver pay trends identified in NTI’s summer 2025 survey data. To review all driver pay trends in depth and to benchmark your company’s pay against select competitors and in the markets you operate, access a subscription to the National Survey of Driver Wages today.

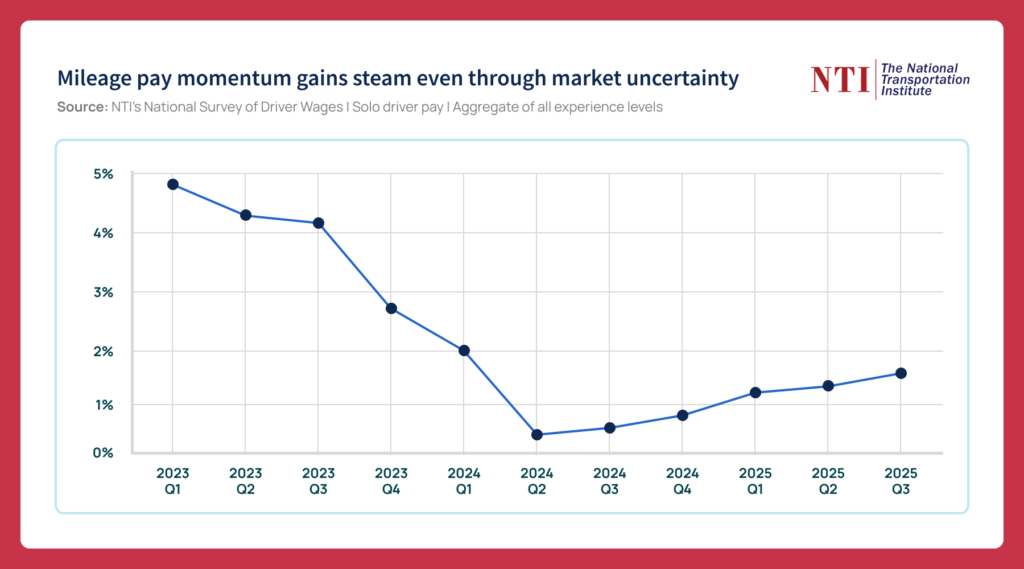

Per-mile pay catches a little more wind in the sails

For the sixth consecutive quarter, the rate of year-over-year growth for per-mile pay climbed, with summer of 2025 posting the largest gain since winter of 2024:

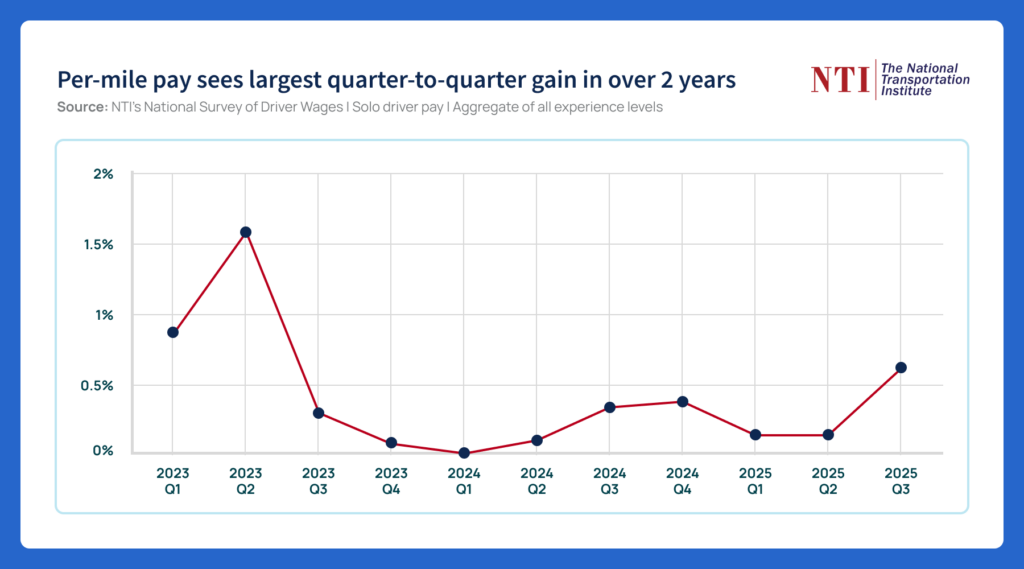

From spring 2025 into summer 2025, per-mile pay saw its largest quarter-to-quarter gain in over two years:

Most prevalent pay ranges

For drivers with 1 year and 3 years of experience, carriers continue to nudge pay into higher pay buckets. NTI charts the prevalence of 5-cent pay ranges, and while the progression up the pay scale slowed slightly this summer, more fleets continue to pay in the 50-60-cent bucket and fewer are paying in the 40-50-cent range.

Of note, for the first time since spring of 2024, the 50-55-cent bucket saw growth in prevalence instead of a decline — but not because fleets regressed in their pay. While the 55-65-cent buckets also saw growth, it is the ranges below 50-55 cents that saw declines and where the increase came from.

Recruiting incentives hold tight

This spring, we reported that the average amount being offered for sign-on bonuses grew for the first time in over two years. Moving into summer, dollar amounts ticked down slightly but were mostly flat, while prevalence of sign-on bonuses grew by a percentage point.

Referral bonuses remain highly prevalent, with nearly 9 in 10 fleets reporting offering the incentive. Dollar amounts have slipped slightly through the freight recession, but have mostly remained steady.

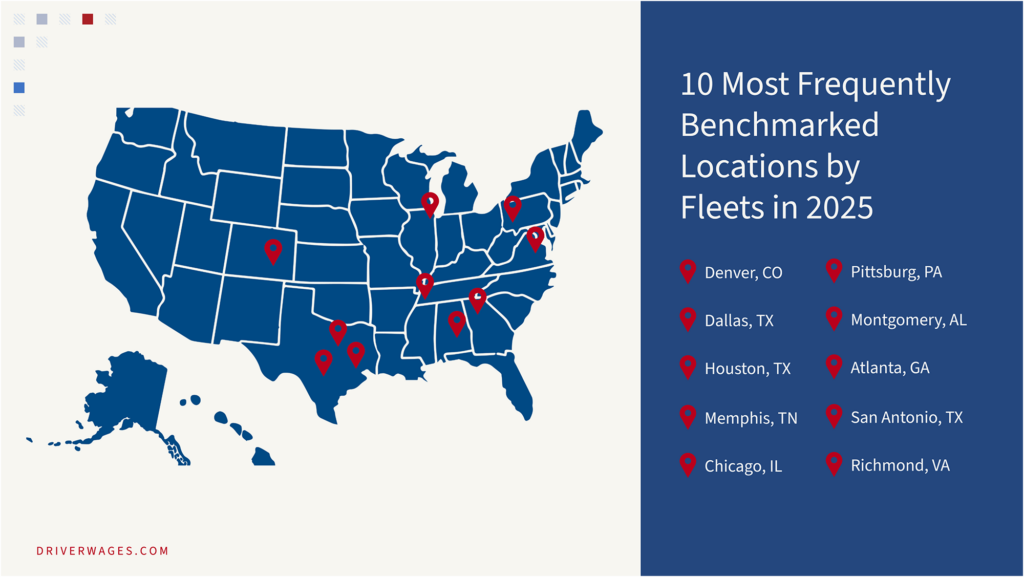

Driver pay hotspots remain in motion in 2025

Throughout 2024, the most frequently benchmarked locations remained mostly unchanged. In 2025, these top locations have remained in motion as freight flows alter amid broader economic and policy changes. Year to date, here are the most frequently benchmarked locations in NTI’s National City-Centric Driver Pay Survey, which reports mileage, hourly, and W2 pay at more than 800 locations nationwide:

Dropping from the Top 10 in spring are Phoenix, Arizona; Charleston, South Carolina; and Cincinnati, Ohio. Those locations were replaced by Montgomery, Alabama; Memphis, Tennessee; and San Antonio, Texas.

From 2024, nearly the entire list has been shuffled. The only two remaining locations are Texas cities Dallas and Houston, while a string of midwestern cities — Kansas City, Minneapolis, Columbus, Indianapolis, and Des Moines — fell out, along with Savannah, Georgia.