Wages for professional truck drivers through the first five months of 2024 show that for-hire fleets remain cautious in 2024 with any wage increases, with the latest survey from NTI’s National Survey of Driver Wages revealing only minimal per-mile pay increases from the same time a year ago for professional drivers across experience levels. Pay is not flat, though gains are muted. Likewise, while there is continued movement in the most common per-mile pay ranges paid to drivers, those changes have slowed considerably as the current freight recession drags on.

NTI’s team has outlined those trends and more in the three charts below documenting highlights from current driver pay survey data of motor carrier employers. To review all driver pay trends in depth and to benchmark your company’s pay against select competitors and the market as a whole, access a subscription to the National Survey of Driver Wages today.

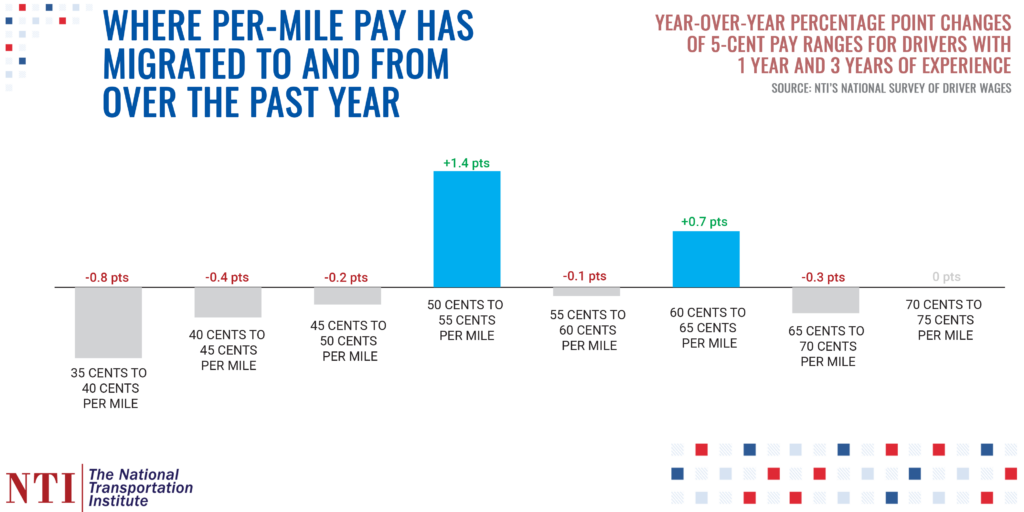

A look at the 5-cent pay ranges where fleets are focusing mileage pay

Compared to a year ago, fleets have focused in on the 50-55-cent per-mile pay band and the 60-65-cent band, with all other 5-cent ranges declining in prevalence by less than a percentage point or remaining unchanged. The National Survey of Driver Wages shows there has been a notable migration of per-mile pay up the scale of these 5-cent buckets, with the 50-60-cent buckets becoming the predominant pay range. In the same time just two years ago, in the spring of 2022, the most common pay range was 40-50 cents per mile. The 55-60-cent bucket has seen the largest momentum, with just 1 in 10 fleets paying in that range in the spring of 2022. That bucket now accounts for more than 1 in 5 pay packages for drivers with between one year and three years of experience.

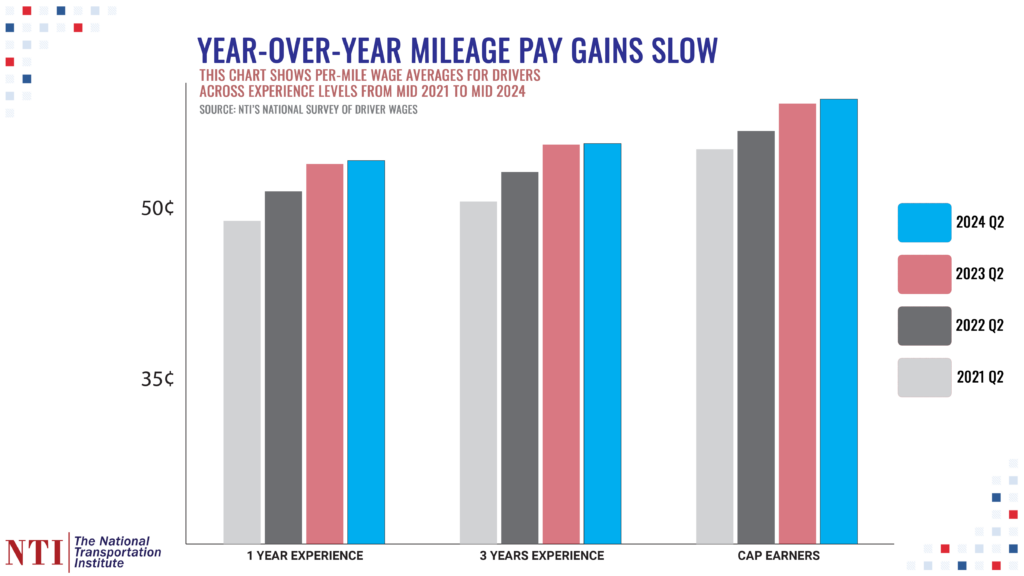

Driver pay movement by experience level shows stalled growth

As the chart above shows, mileage pay for drivers with one and three years of experience soared in 2021, 2022, and 2023 comparing year-over-year data. That rapid growth has now slowed in 2024 compared to the same time a year ago, with mileage pay inching up only slightly over the past 12 months.

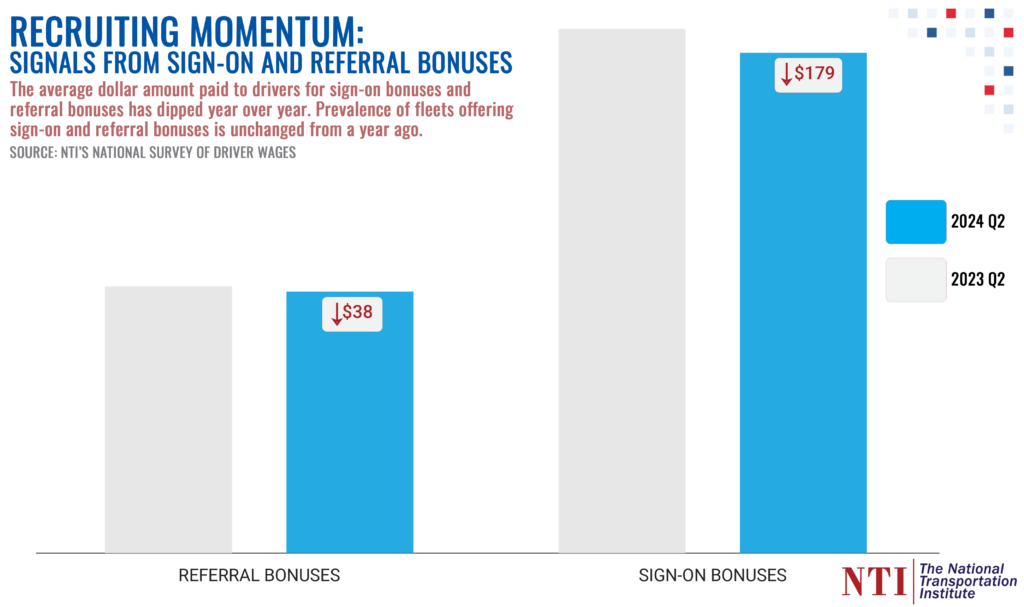

Trends in sign-on and referral bonuses

Despite stalled pay gains and the ongoing freight recession, however, indicators of recruiting activity remain nearly unchanged from a year ago and only point to minor dips compared to the 2021-2023 timeframe. For example, the prevalence of referral bonuses has climbed in the current quarter from the same time a year ago, while the percentage of fleets paying sign-on bonuses remains unchanged. Prevalence of sign-on and referral bonuses is higher than in the springs of 2021 and 2022. The dollar amounts for both have declined year over year, but remain in line with where these recruiting incentives were in 2021 and 2022.