Driver pay has seen its largest year-over-year gains in 2024 during the final months of the year, albeit those gains remain sluggish, according to current data in The National Transportation Institute’s National Survey of Driver Wages. Per-mile wages across experience levels — 1 year, 3 years, max experience, and cap earners — rose a percentage point from the same time in 2023. Those gains build on the late summer momentum NTI reported in September.

Wages for professional truck drivers at for-hire motor carriers remain somewhat muted, with small incremental gains year over year and from summer to fall across the board for mileage pay and for W2 earnings nationally and at the market / location level. The lingering freight recession that began in late 2022 continues to limit fleets’ appetite for pay increases despite ongoing driver turnover and elevated hiring trends.

The charts and notes below outline the driver pay trends identified in late 2024 survey data published by The National Transportation Institute, including a look at how pay has changed in some of the most frequently benchmarked locations throughout the year. To review all driver pay trends in depth and to benchmark your company’s pay against select competitors and in the markets where your fleet operates, access an NTI subscription today.

For drivers with 1 year and 3 years of experience, mileage pay keeps inching up the scale

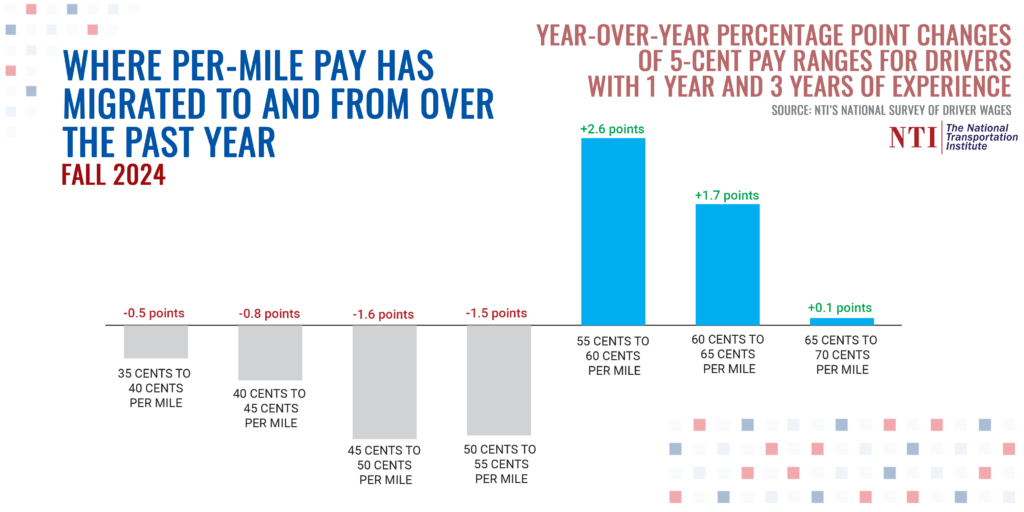

Despite the ongoing freight market challenges and factors restraining driver pay momentum, a high-level view of the wage market shows that base mileage pay for drivers with 1 year of experience and 3 years of experience continues to move into higher pay bands, according to data from NTI’s National Survey of Driver Wages.

Lower per-mile wage ranges such as 40-50 cents per mile continue to see fewer fleets paying in those buckets, while ranges in the 55-cent-plus continue to see gains. That trend has persisted throughout the freight market downturn and has seen renewed momentum in the back half of 2024. All 5-cent pay ranges at 55 cents and higher have seen gains, up to the 75-cent-per-mile range, while prevalence for all bands below 55 cents declined.

Here’s a look at the changes throughout 2024:

No slowdown in recruiting bonuses

Recruiting momentum indicators such as sign-on bonuses and referral bonuses have remained steady not only throughout 2024, but also throughout the freight recession over the past two years. Prevalence of sign-ons and referrals has dipped slightly from their peaks in 2022, as have the dollar amounts paid for those bonuses. But unlike prior freight recessions when bonuses tended to fall off as wages stagnated, that trend did not materialize in the current market.

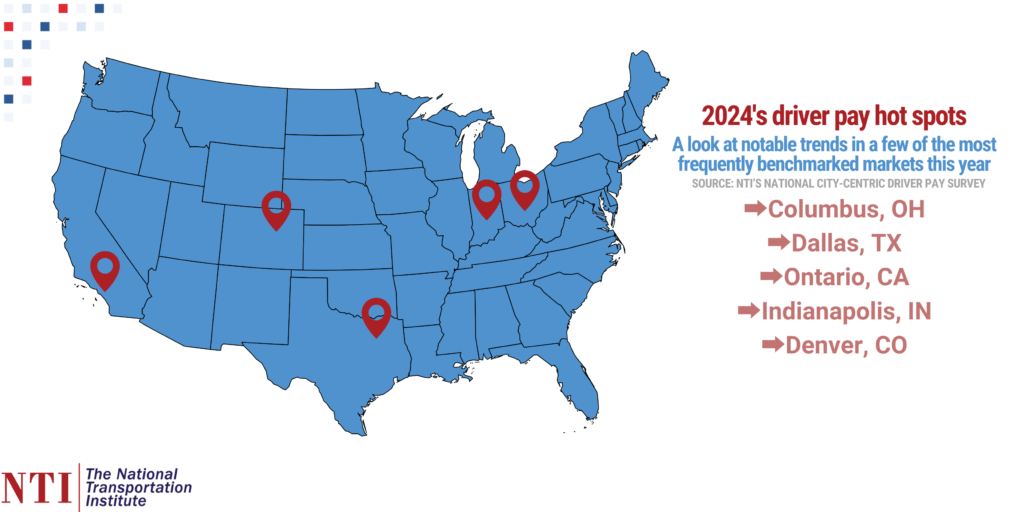

Driver pay’s hot spots: A look at momentum in a few of the most frequently benchmarked markets

Nationally, annual earnings for professional drivers have seen roughly the same changes as base pay through 2024 — about a percentage point gain. However, in some of the most frequently benchmarked locations from NTI’s National City-Centric Driver Pay Survey, which tracks market-level mileage, hourly, and W2 pay at more than 800 locations, a few trends have appeared in the segments and job-specific data.

Here’s a look at some of highlights from those frequently benchmarked markets:

➡️ Wages for regional drivers in the Dallas market are outpacing national median and 75th percentile annual earnings by 10% and 6%, respectively. Among segments (local, regional, dedicated, and OTR) and top benchmarked locations, Dallas’ regional wages have the largest gap between national numbers.

➡️ Pay for drivers at dedicated fleets in the Columbus, Ohio, market has the strongest momentum in 2024 among the most frequently benchmarked locations.

➡️ Denver across the board has the strongest annual earnings compared to national averages in the segments tracked in NTI’s National City-Centric Driver Pay Survey and among the most frequently benchmarked markets. The data tracks with anecdotal evidence that NTI has heard from motor carriers and private fleets about the challenges the Denver market presents in establishing the right pay programs and marketing pay rates to drivers in recruiting and retention programs. Denver’s OTR pay is over 4% stronger than the national OTR annual earnings, while pay for dedicated drivers in the market are nearly 6% higher than national annual earnings for dedicated drivers.

➡️ Indianapolis is second to Denver in its overall strength across the board among the 10 most frequently benchmarked locations, particularly for dedicated drivers and OTR.

➡️ As a shipping hub adjacent to the Los Angeles market, pay for drivers in Ontario, California, outpaces the national numbers by a few percentage points across segments, and has a particularly strong showing for dedicated drivers.