Building on an uptick in momentum from the back half of 2024, driver wages at for-hire fleets in the first months of 2025 show their strongest year-over-year gains in a year, according to NTI’s National Survey of Driver Wages.

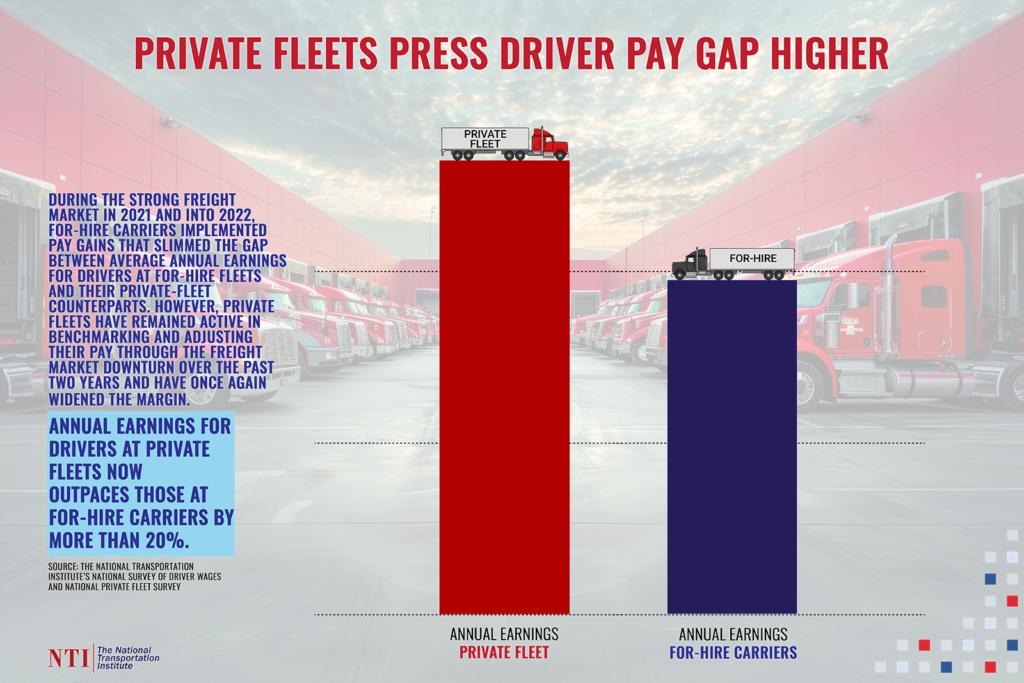

Signals remained mixed as to whether the broader freight market is entering a recovery period after a years-long ebb that prompted many for-hire fleets to slow or pause pay changes. However, after a multi-quarter lull to end 2023 and begin 2024, that stagnation has ended, and activity in driver pay adjustments has shown signs of life at for-hire trucking companies since late summer of 2024. Meanwhile, at private fleets, dedicated 3PLs, fleets with labor or more nuanced jobs, and those with location-based hiring and compensation models, pay benchmarking and adjustments have remained active — as we detailed here in the NTI Blog.

Here are three key trends we’re watching in the first months of 2025:

After a stagnant stretch, base pay movement resumes, and year-over-year gains grow

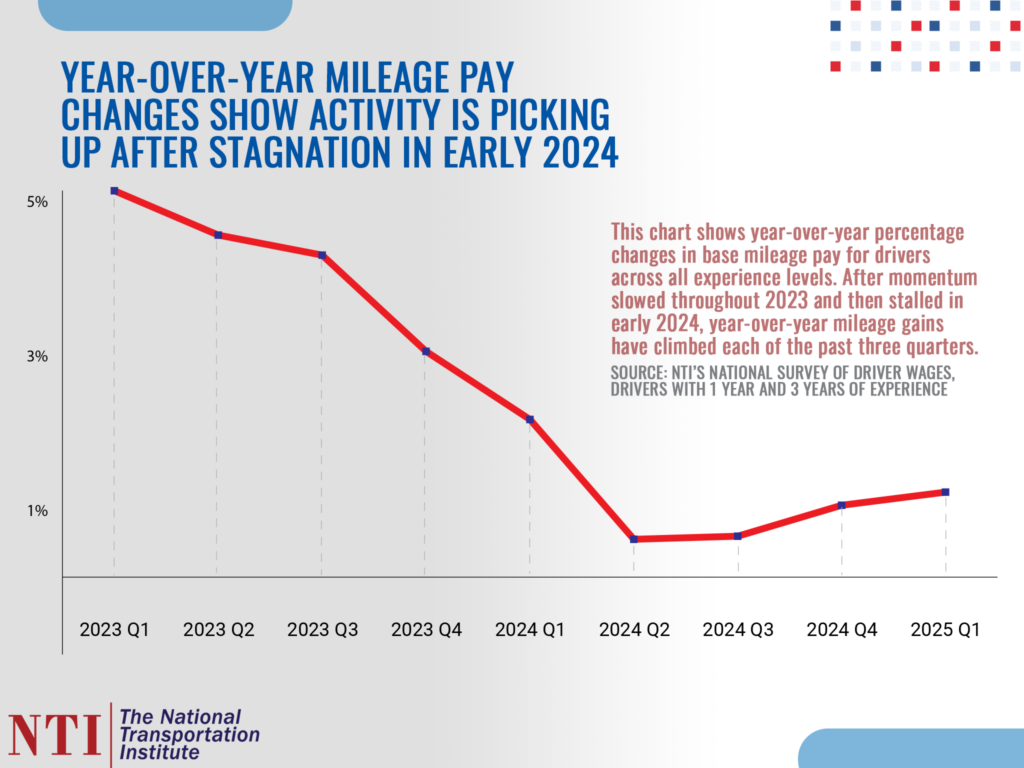

In late 2023 and early 2024, base pay changes at for-hire motor carriers stalled. Starting in the latter half of 2024, however, that stagnation period broke, and wage momentum has entered a slow-growth upward trajectory.

In early 2025, that’s highlighted in the chart below. While quarter-to-quarter gains in the first months of 2025 slowed slightly compared to those in late 2024, year-over-year comparisons are growing:

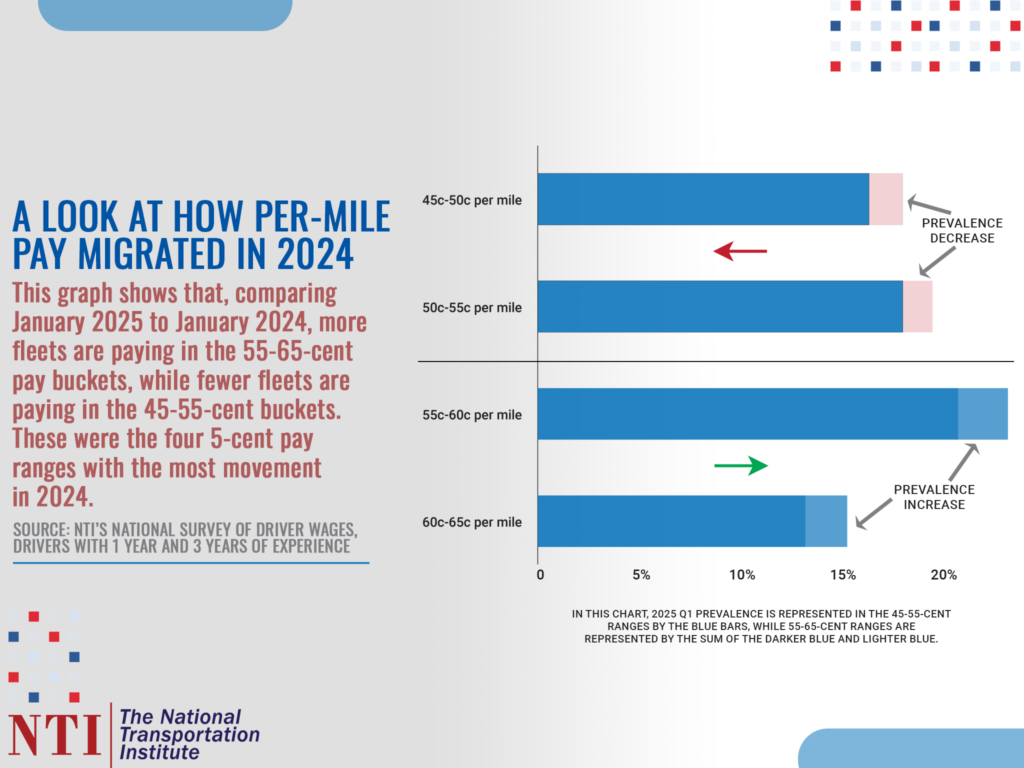

Though the ongoing weakness in the freight market continues to restrain driver wage growth, as as the chart below shows, for drivers with 1 year of experience and 3 years of experience, for-hire fleets continue to nudge their pay packages higher, with the 45-55-cent pay ranges seeing less prevalence, and 55-65-cent ranges seeing higher prevalence:

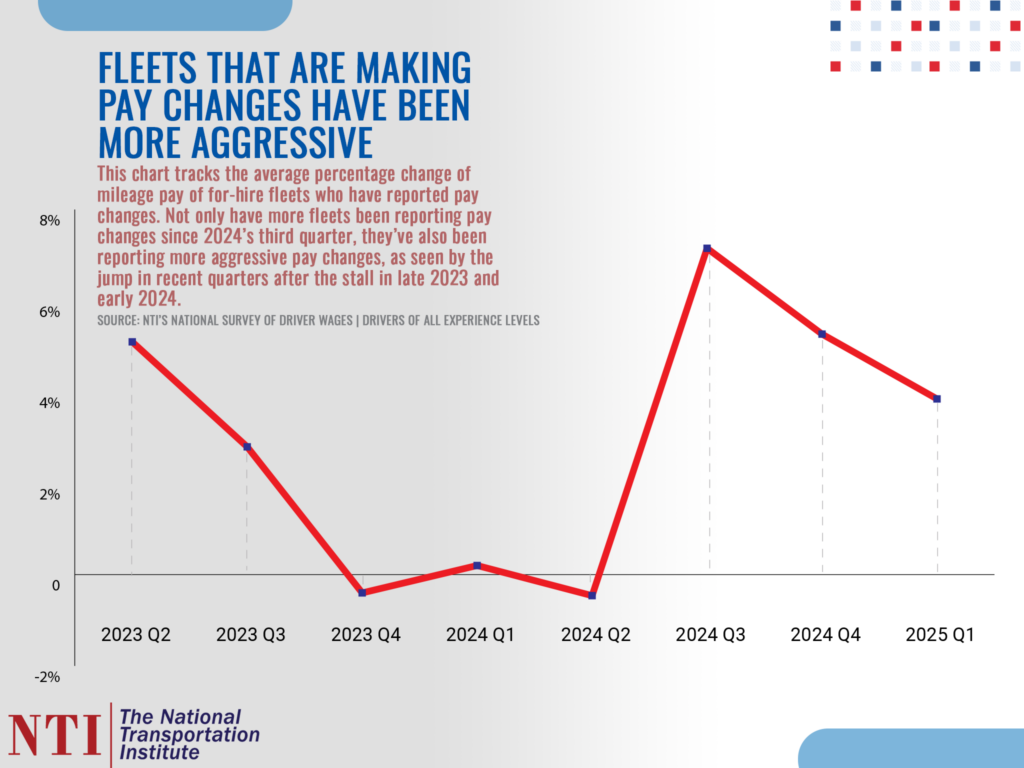

Fleets who are reporting pay changes are getting more aggressive

As the chart below shows, of the fleets who report pay changes in the National Survey of Driver Wages, the rate of those pay changes has jumped. This chart also shows the stagnant period at the end of 2023 and into early 2024 — and then a shift as pay changes resumed:

The more nuanced the job, the more active the pay adjustments

In late 2024, we reviewed what more granular, location-based survey data revealed in comparing some of the most frequently benchmarked locations in the U.S. See that recap here.

More broadly though, that trend has become deeply entrenched: Every job within every market has reacted differently to the wage pressures and market dynamics over the past four years. That’s particularly true for private trucking fleets, dedicated 3PLs, and the myriad of for-hire trucking companies working anything beyond general truckload in OTR and long-haul. And even those jobs are shifting.

Active and detailed benchmarking has been particularly prominent among fleets hiring for jobs in the narrower parts of the hiring funnel, such as those with more stringent hiring qualifications, labor-intensive positions, tanker jobs, teams, and more — think energy companies and fuel haulers, grocers and food suppliers, construction materials distributors, and retailers.

Driver pay models — and driver pay movement — operate on a gradient. That’s a trend that has been developing and evolving over the past decade, but in the past two, it has become a core principle of driver compensation planning, and data published by The National Transportation Institute makes this clear. The more unique the job, the more attention fleets put on their pay packages, their benchmarking activity, and their adjustments, even through a tougher freight cycle like over the past two years.

See our recent recap of that data in this post.