Wages for professional truck drivers at for-hire motor carriers remain mostly in a holding pattern in summer 2024, with the factors that influence driver pay movement, such as freight rates and demand for trucking capacity, stuck under the thumb of the lingering freight recession. Current market conditions, particularly for for-hire trucking companies, have limited fleets’ appetite for raising base pay for drivers.

However, despite the freight market malaise and 2024’s overall sluggish pay movement, the summer months did bring the most movement to driver wages so far this year, according to the latest data from NTI’s National Survey of Driver Wages. The charts and notes below outline the driver pay trends identified in NTI’s summer 2024 survey data. To review all driver pay trends in depth and to benchmark your company’s pay against select competitors and in the markets you operate, access a subscription to the National Survey of Driver Wages today.

Per-mile pay resumes its shift up the pay scale

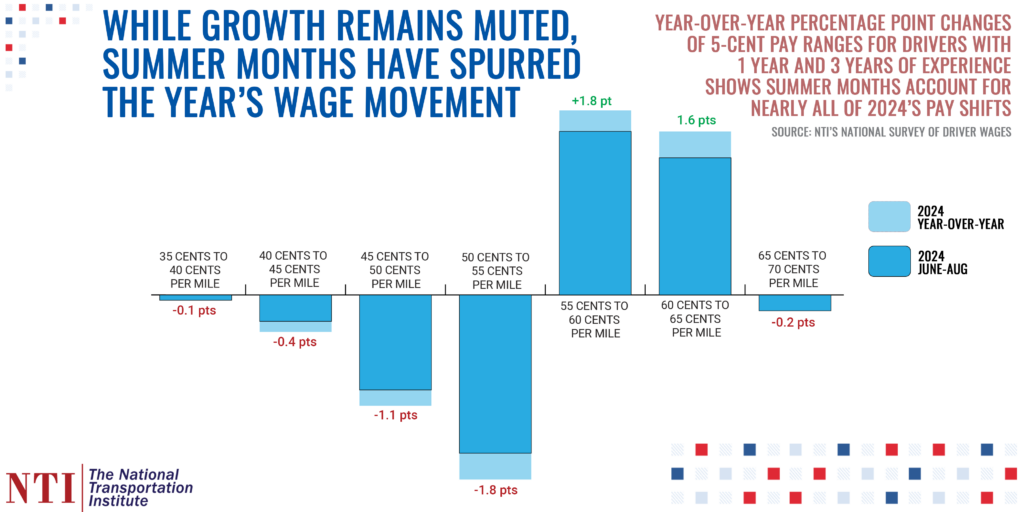

Looking at the most prevalent per-mile pay ranges for professional drivers at for-hire carriers, broken into 5-cent pay ranges, movement up the scale resumed this summer — with the summer months of 2024 accounting for nearly all of the year-over-year gains from the same time frame in 2023.

Over the past two years, as wage growth plateaued, per-mile pay has increasingly been coalescing into the 50-60-cent range for drivers with one year of experience and drivers with three years of experience. This trend is shown in the chart below, which shows the continued growth in prevalence of those two 5-cent pay ranges.

As the chart also shows, 2024’s summer months account for nearly all of the year’s shifts:

A look at pay movement by experience level

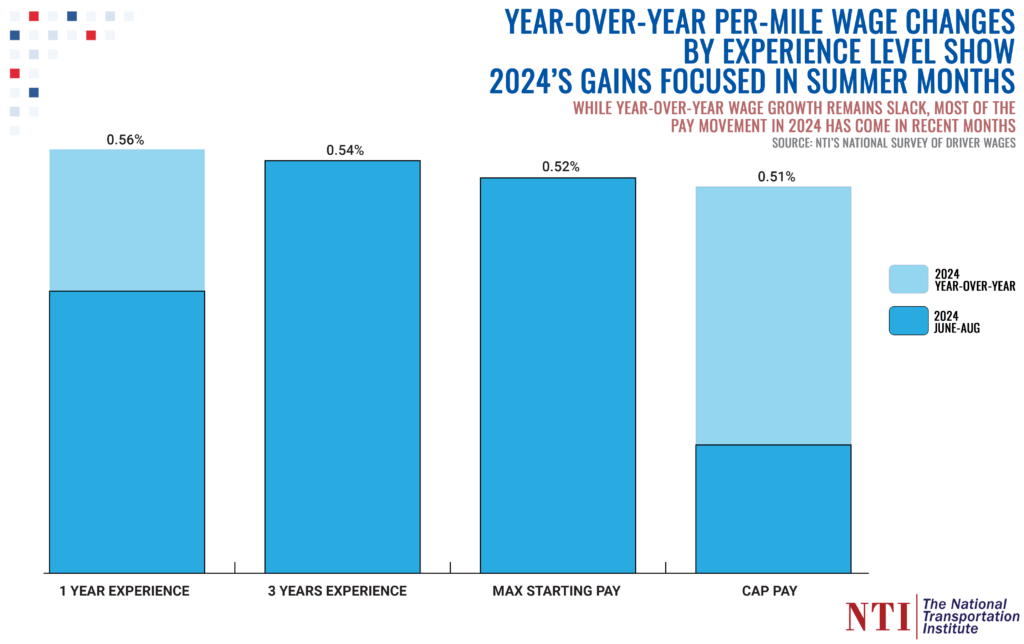

While year-over-year pay changes by experience level are minimal, 2024’s summer months have shaken loose the gridlock from earlier this year, particularly among a highly sought-after cohort: Drivers with three or more years of experience. All of the gains for three-year drivers and maximum starting pay drivers (those with roughly five or more years of driving experience at their time of hire and who are paid the company’s highest starting wage) came this summer, jumping up to match the year-over-year gains of 1-year drivers and cap earners (those who’ve reached the top-end of the wage scale at their company):

A quick glance at the most active markets

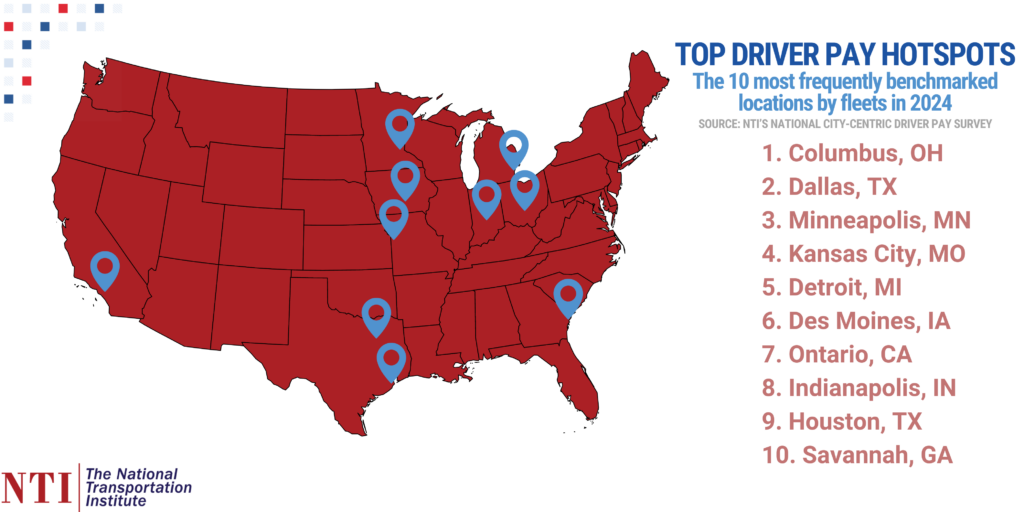

The National Transportation Institute tracks pay by driver job type (local, regional, OTR, and dedicated) at more than 800 locations nationwide. The chart below highlights the 10 most active locations benchmarked in 2024. Fleets of all types, but especially those with the most effective recruiting and retention programs, increasingly are shifting to location-based hiring models — and compensation structures that fit those models. We explored why in this blog post from earlier this year.

➡️ Want to gain access to NTI’s authoritative benchmarking data to steer your fleet’s strategies and success in driver compensation, recruiting, and retention? Contact our team of experts today to learn more.