Yes, that’s an eye-popping number. Especially since unaccounted for in that number are the likely thousands more non-domiciled CDLs and learner’s permits that would have been issued and new drivers added to the industry’s total rolls, as the federal government’s recent regulatory change also forces states to pause issuing any new non-domiciled CDLs while U.S. DOT performs an audit of state licensing agencies. Also unaccounted for in that number are voluntary preemptive exits by drivers, as well as preemptive action by carriers who may choose to cut ties with such drivers.

The 200,000 drivers estimated to be driving today with now-ineligible non-domiciled CDLs will continue to operate for a period of time, though it’s unclear how long. Some may have up to two years, until their renewal period, at which case DOT says they will not be eligible to renew. Some CDLs may be revoked fairly quickly, as DOT’s new emergency rule requires state licensing agencies to remove CDL privileges if they are notified by U.S. DOT, the Department of Homeland Security, the Department of State, or another federal agency that an individual’s non-domiciled CDL was improperly issued.

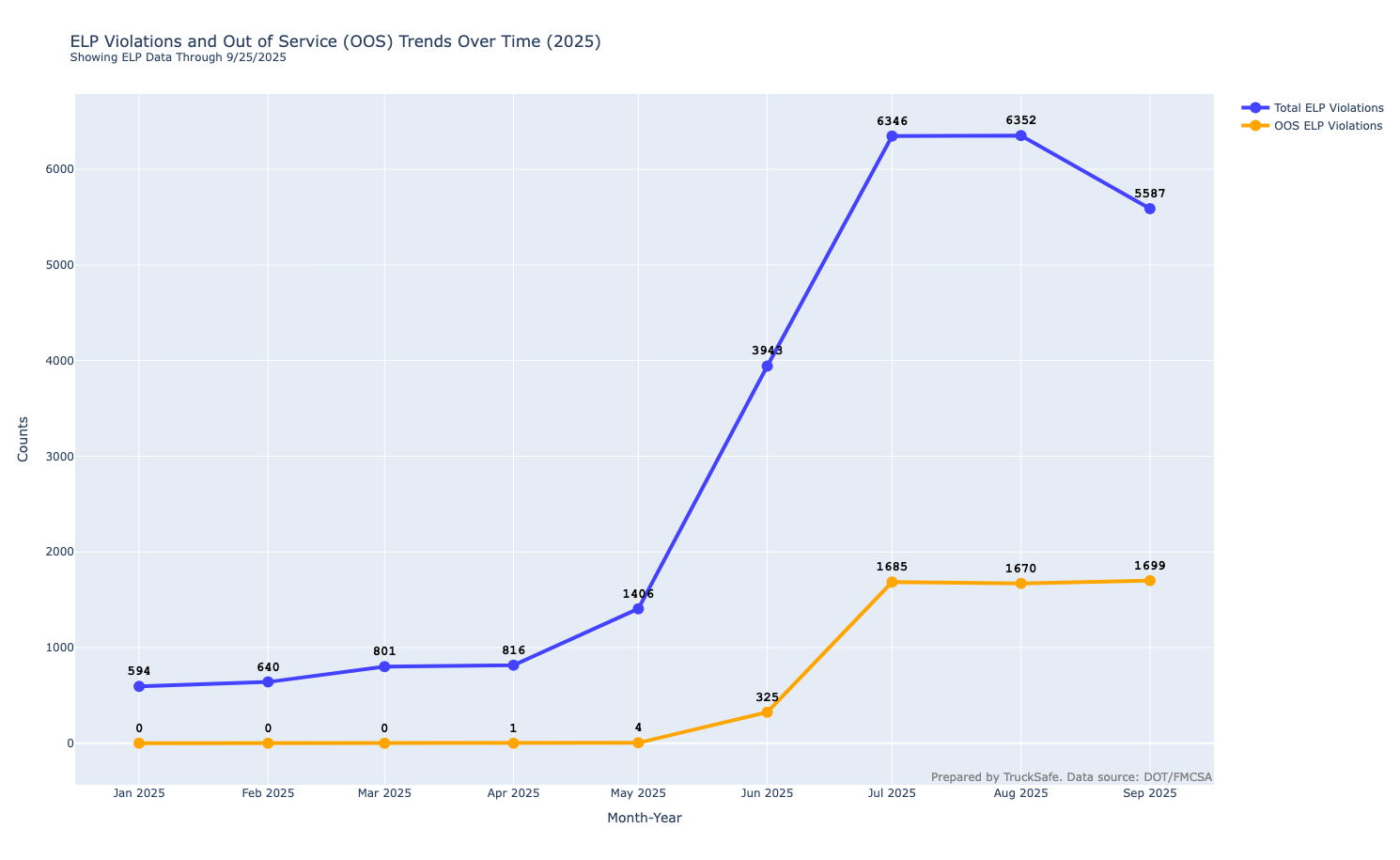

The changes to immigrant-focused CDLs also comes as another regulatory change implemented this summer is also removing drivers from the industry. Stricter enforcement of English-Language Proficiency requirements, which now carry an immediate out-of-service order along with ramped-up focus at roadside inspections, is sidelining more than 1,500 drivers a month on average. That’s in addition to deterring new entrants who don’t meet ELP requirements and self-regulating by fleets who may also be forced to cull some of their existing drivers who aren’t qualified.

While ELP and the ongoing end to non-domiciled CDLs are shiny objects right now, they’re not going to reshape driver supply overnight. However, the convergence of the issues outlined below, combined with the exacerbating effects of the removal of these hundreds of thousands of drivers from the population, will likely have dramatic effects in the years ahead as the industry contends with a workforce quickly aging out and few newcomers replacing them.

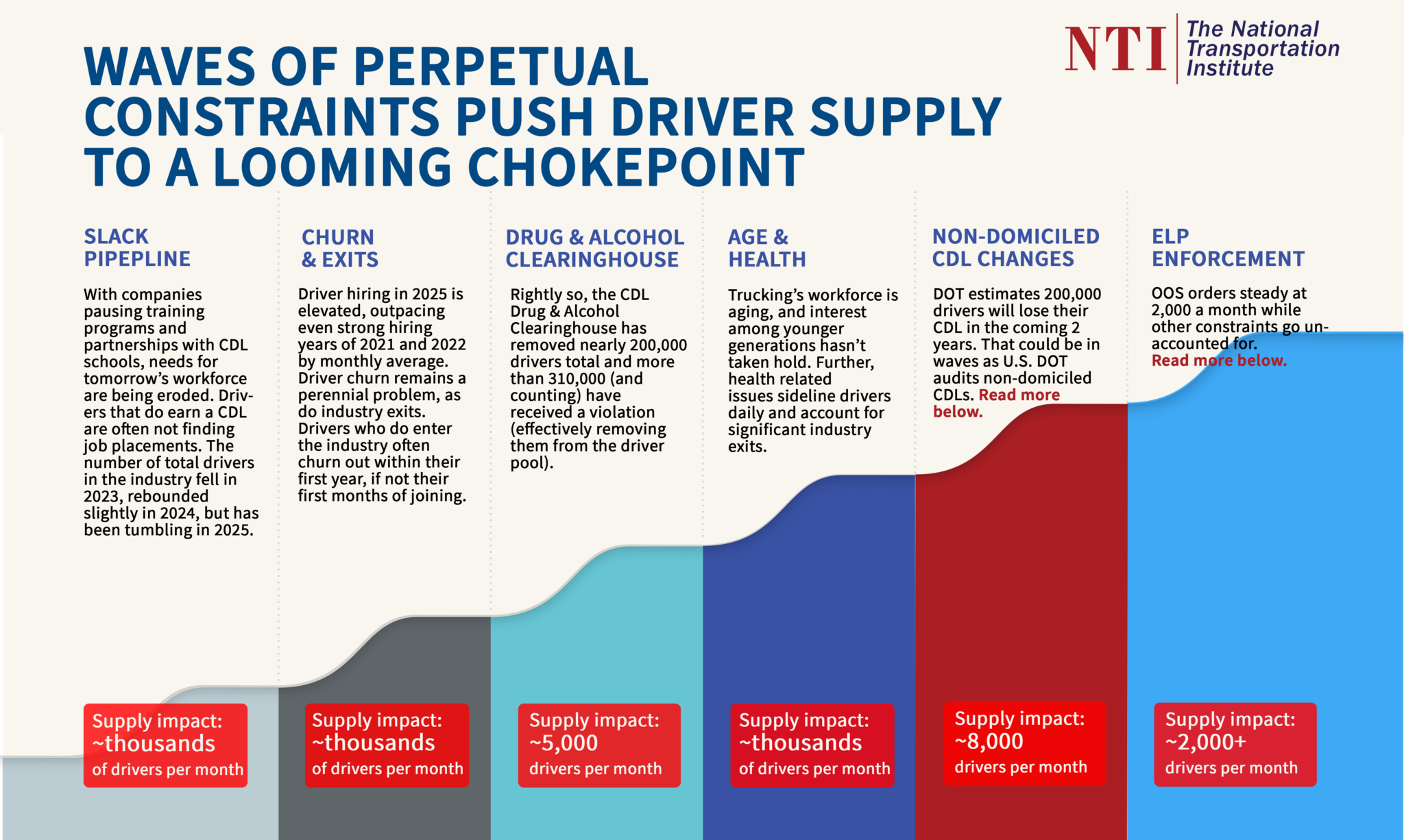

The issues of non-domiciled CDLs and ELP enforcement collide with the other slow-building perpetual driver supply constraints that have been chipping away at the industry’s workforce. The freight downturn over the past three years has masked underlying structural issues that will likely become dire in the next freight upcycle and beyond.

NTI has outlined these constraints in its annual Driver Market Forecast in recent years, which you can read here. This outline below updates those trends with the additions of the impacts of ELP and non-domiciled CDLs

As discussed above, DOT’s actions immediately halt new issuance of non-domiciled CDLs and will see an estimated 200,000 CDLs removed over the coming two years. Non-domiciled CDLs are those issued to someone who is either not a citizen of the U.S. or not a permanent resident, but who has passed a driving skills test and has completed other administrative tasks.

DOT’s rule change now limits such CDLs to drivers who hold specific visas — H2B, H2-A, and E-2. Other administrative changes also intend to narrow the process by which foreign workers can obtain a non-domiciled CDL and work as a professional driver in the U.S.

The bottom line right now relating non-domiciled CDLs to driver supply, however, is that U.S. DOT anticipates approximately 200,000 CDLs, and thus drivers, to be weeded out during this regulatory change. It’s unclear how quickly these drivers will leave the industry, but it’s likely to be on a rolling basis starting now and through 2027.

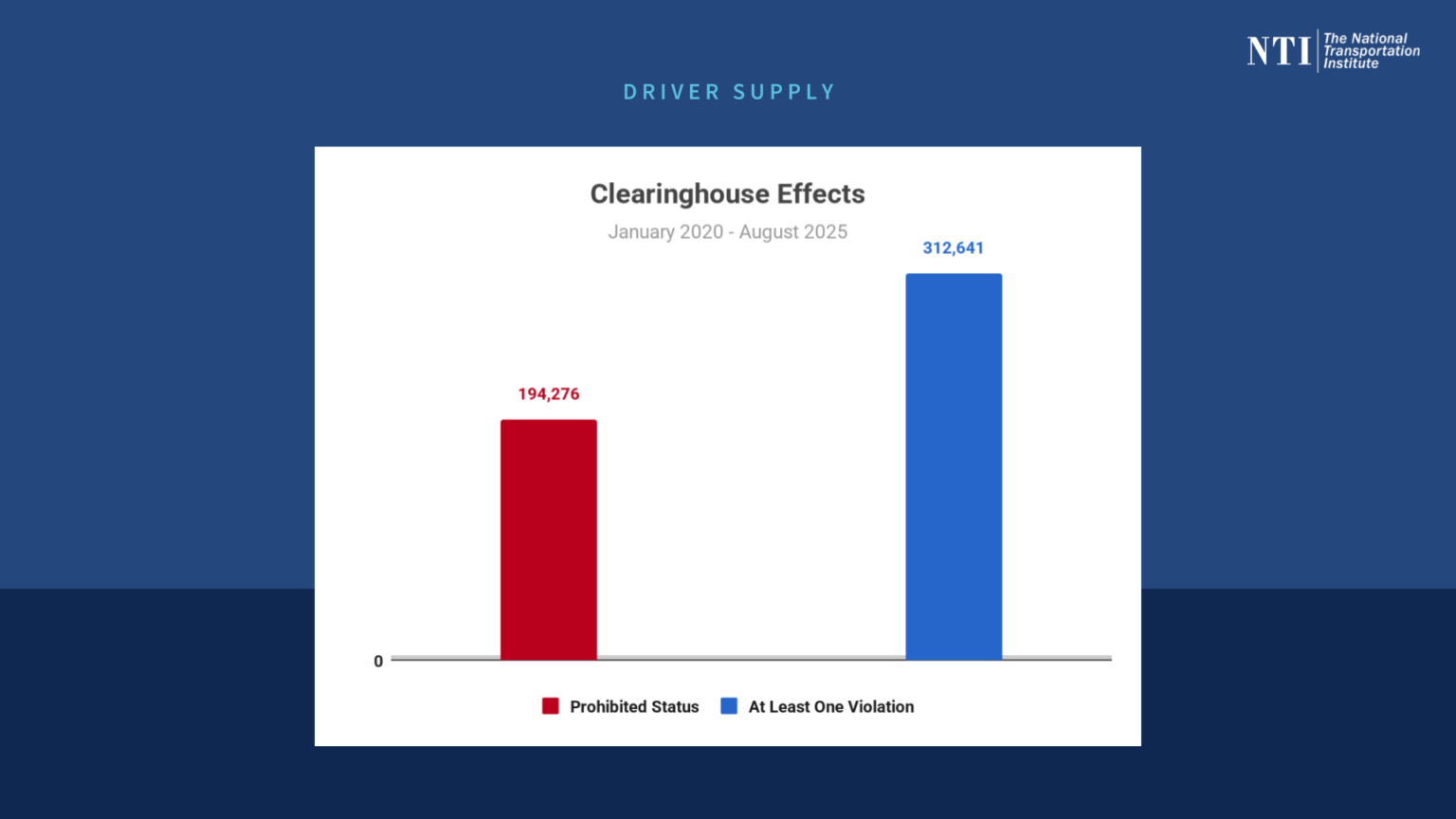

NTI has been documenting the impact of the CDL Drug & Alcohol Clearinghouse for nearly six years, since its inception in January 2020. On average, 5,000 drivers a month are flagged for violations and sent to prohibited status, with nearly 315,000 drivers having received a violation from January 2020 through August 2025.

While roughly 25% of them have completed return-to-duty protocol, nearly 195,000 drivers remain in prohibited status. However, many, if not most, fleets will not hire a driver with a drug or alcohol violation on their record, meaning the larger number — 315,000 — is likely closer to the more accurate representation of the Clearinghouse’s impact on driver supply.

What’s more, with the changing landscape of marijuana laws across the country over the past decade, many workers will opt against entering a federally regulated industry requiring drug tests, which also has an impact on driver supply.

NTI recently explored stricter enforcement of English-Language Proficiency regulations in this resource. In addition to its impact on driver supply, there are other impacts fleets need to be aware of too. Read that resource in full here.

As it relates to driver supply, out-of-service orders associated with ELPs are already having an impact, with more than 5,000 drivers placed out of service in the first three months of enforcement.

As noted above, unaccounted for in those numbers are fleets self-regulating and removing drivers who may not be qualified, as well as new drivers who will now no longer seek jobs in trucking because of stricter ELP enforcement. So while there is hard data representing the impact of these regulatory changes, the full extent is likely even greater.

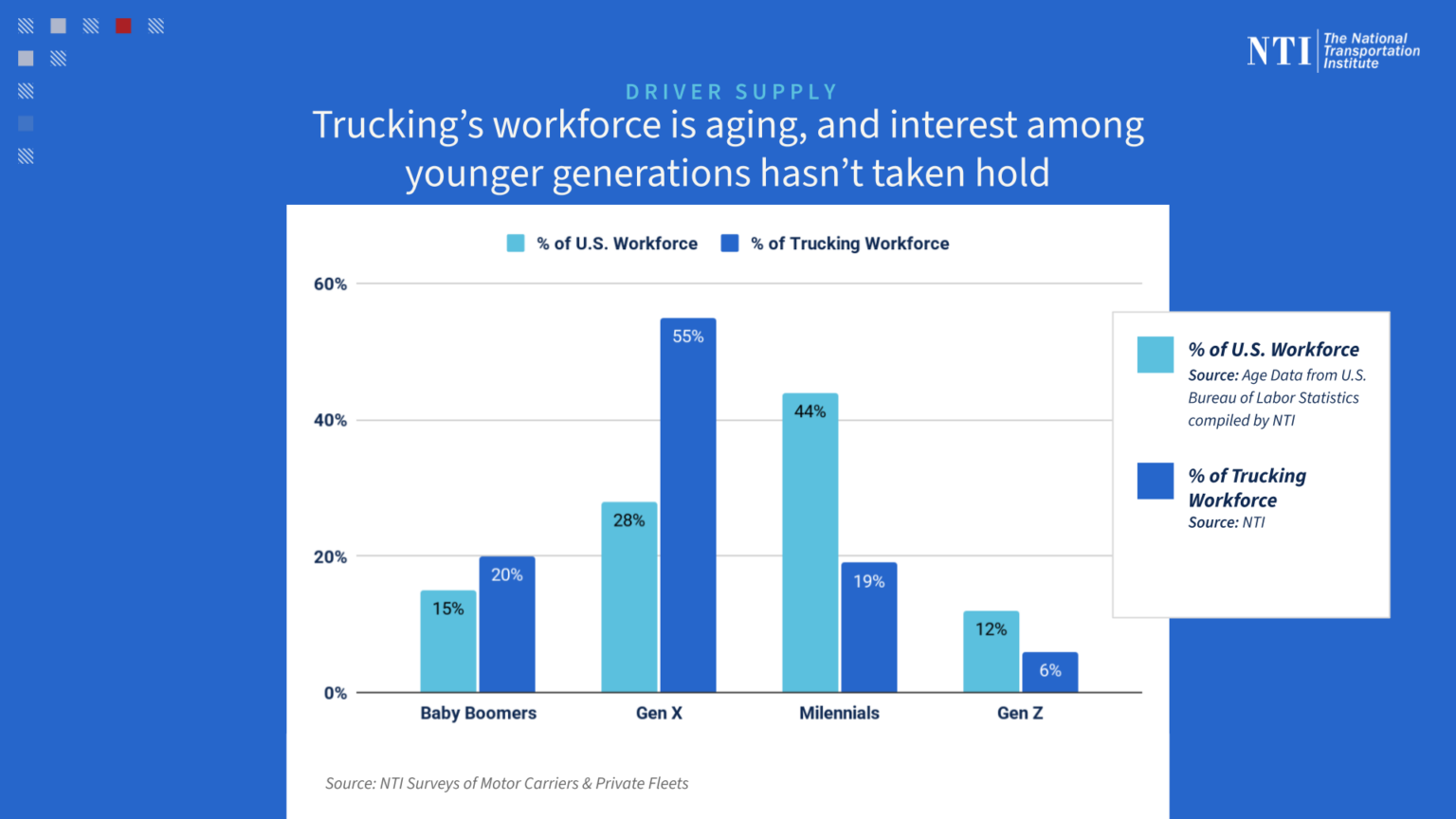

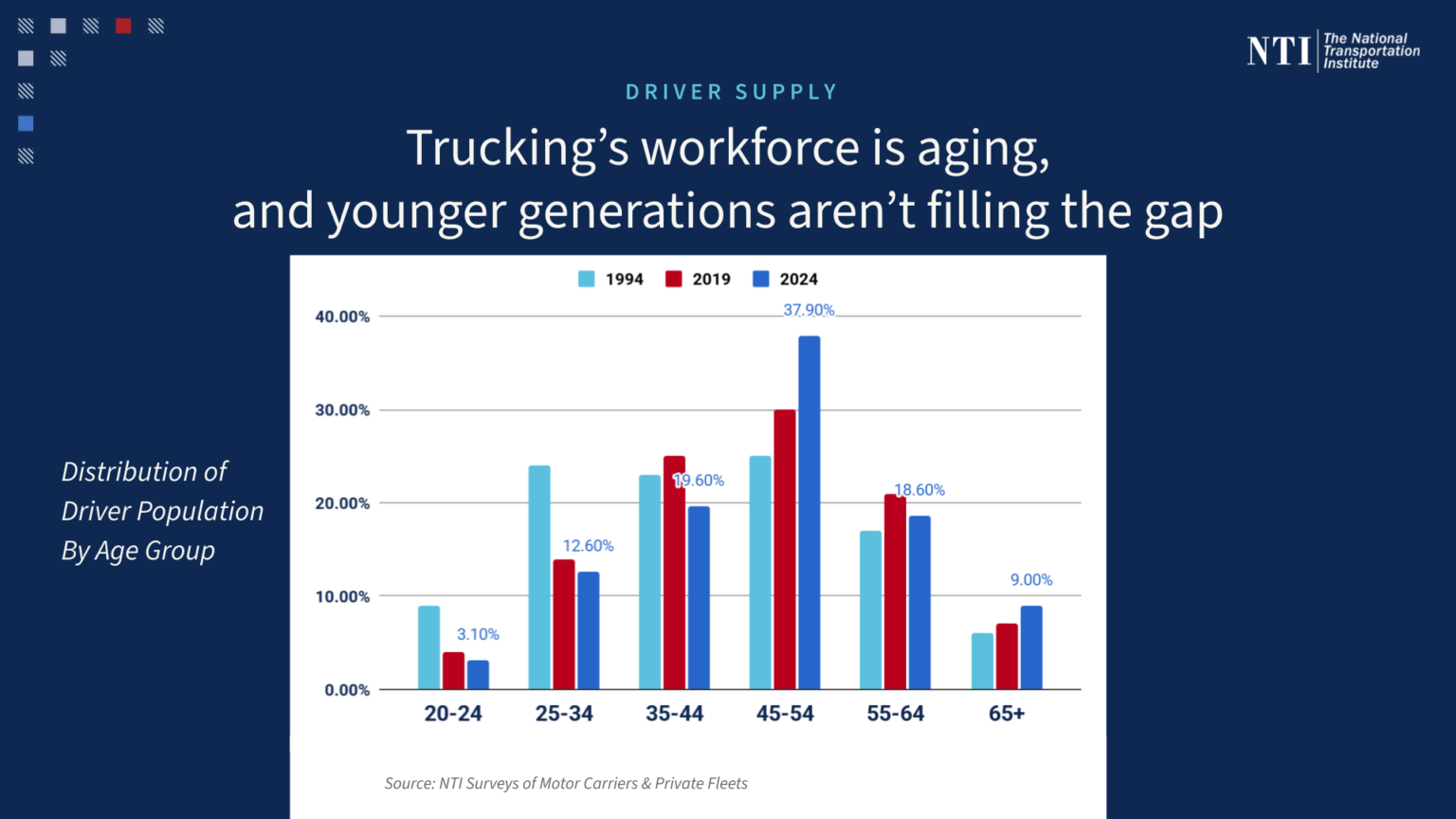

Age and health factors have immense impacts on a driver pool that is aging out, wearing out, and retiring out. Roughly half of all drivers operate on a short-term medical card of one year or less — just half of the standard two-year medical certification. What’s more, the driver population has aged dramatically since 1994, including a big shift older over the past five years. Younger generations aren’t entering the industry to backfill trucking’s workforce as drivers age out.

With many companies pausing training programs and with enrollment at training providers down dramatically, the foundation for tomorrow’s driver workforce is eroding. Newly licensed drivers — those who earned a CDL expecting to join a specific fleet or find a job in trucking at all — are now stalled on waiting lists or shut out due to lack of experience. The few positions available to them are often the most demanding: long-haul, irregular-route OTR jobs with limited home time and the lowest pay among segments. Even those who land a role often become disillusioned quickly, and churn among new entrants remains especially high in the first 120 days.

That same pattern unfolded in 2019. After the 2018 freight boom cooled, the market swung from tight capacity to oversupply, fleets scaled back, and the driver pipeline collapsed. When demand returned in late 2020, carriers had to rebuild their hiring and training channels from scratch — creating enormous pressure to grow quickly and driving wages sharply upward.

This is a point NTI has been making since the beginning of the current freight recession in late 2022. Because capacity has been in excess and drivers have been plentiful, the industry has removed its emphasis on attracting newcomers and backfilling drivers who leave.

Drivers who do enter the industry have a high churn rate, cycling out within their first year, if not their first months after entering trucking.

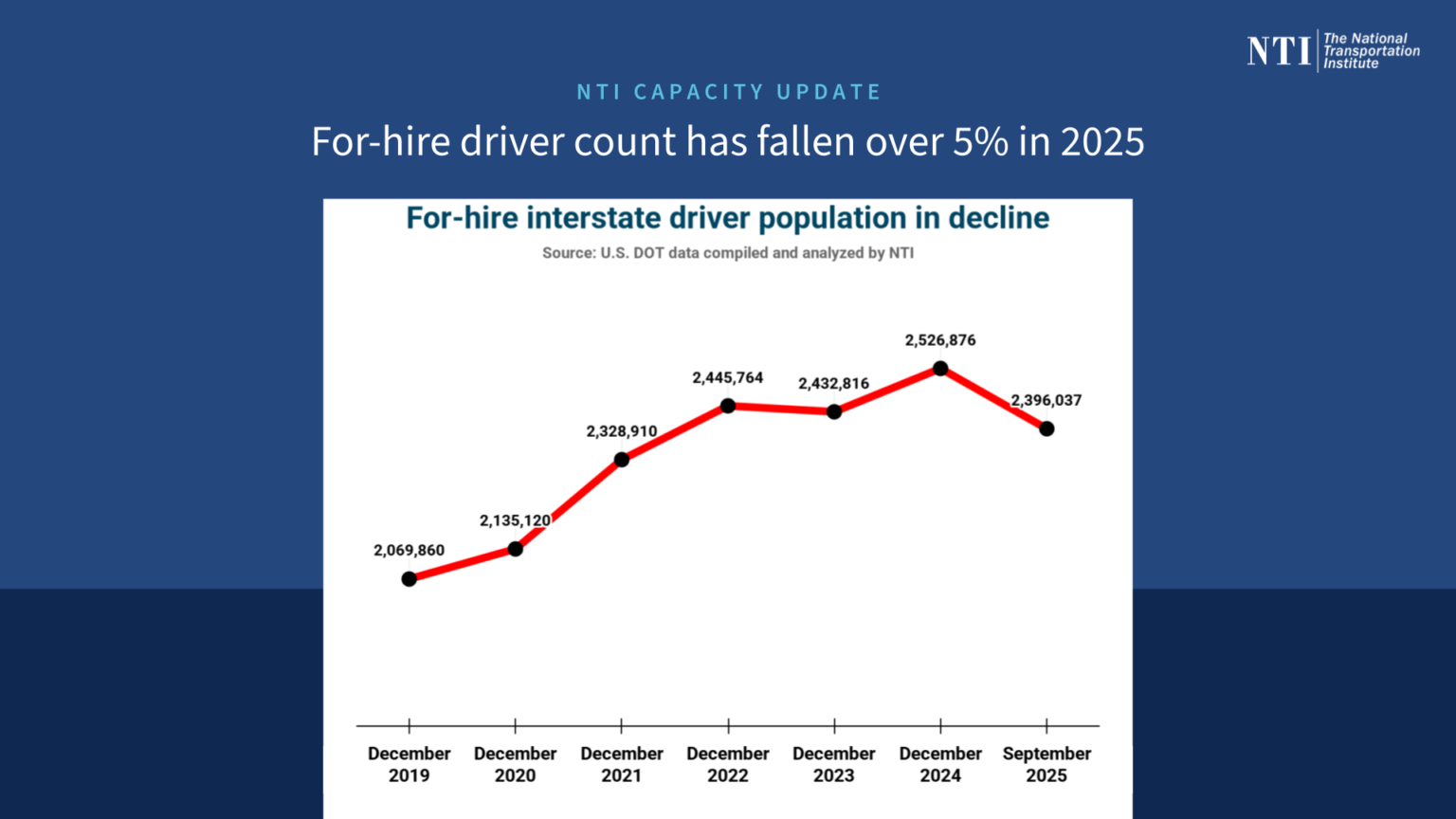

As the charts below show, the number of for-hire interstate drivers is in a quick decline this year. While the number rebounded last year after a slight dip in 2023, through the first eight months of 2025, the number has now fallen below where it was at the end of 2022.

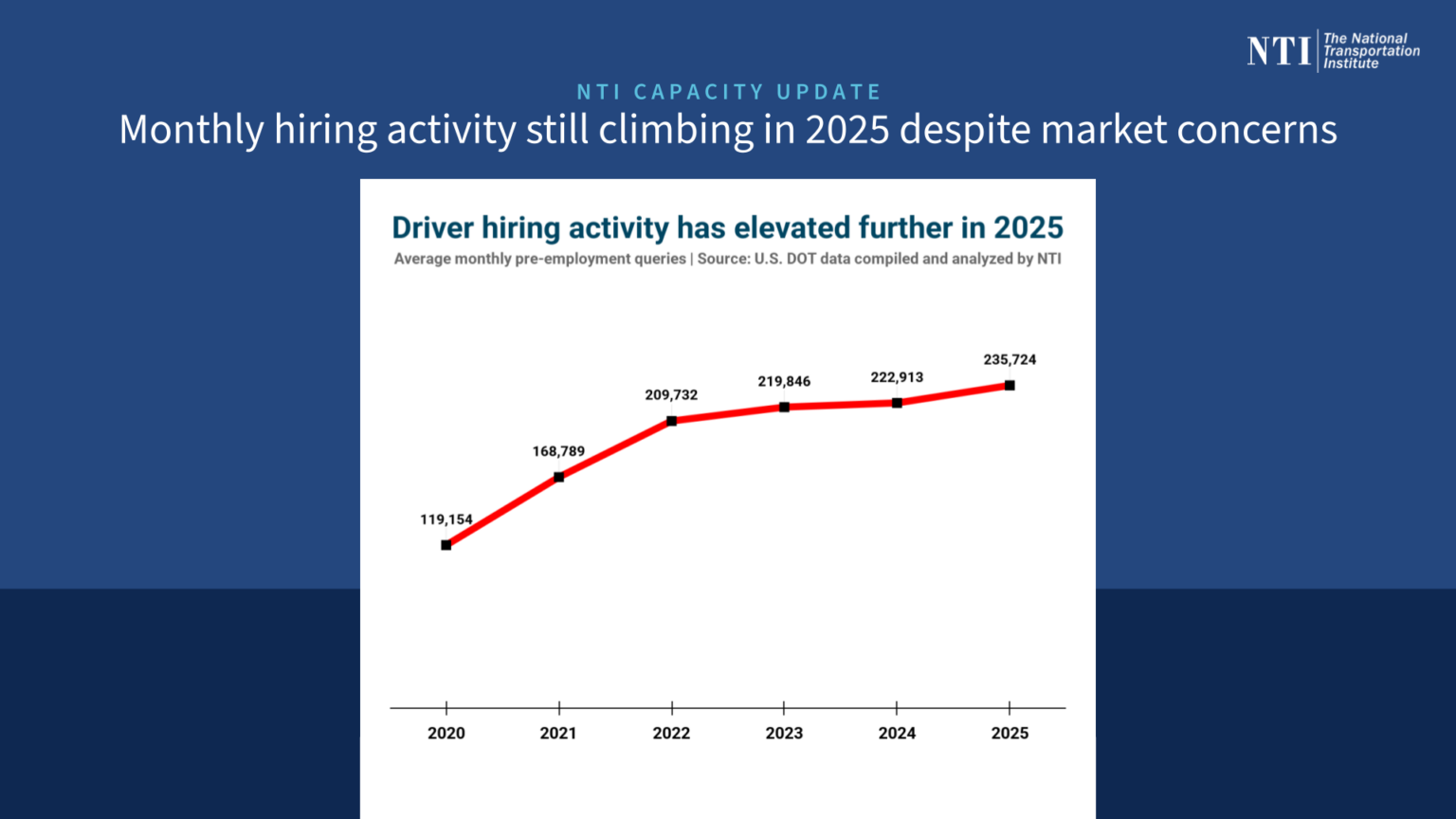

That trend is taking place at the same time that driver hiring numbers continue to climb in 2025. NTI contends that points to elevated turnover and drivers exiting the industry and fleets hiring to replace them, since fleets generally aren’t growing in the current freight market environment and since driver numbers are falling.

In the near-term, these supply constraints will likely have minimal impact on momentum of driver pay movement. However, they will in time put upward pressure on pay, particularly when the industry cycles into a phase where demand begins catching up with capacity or surpassing it. These supply-side constraints could create intense challenges for fleets to fill necessary roles, maintain headcount, meet customers’ capacity needs, and create sustained wage pressures like those seen in 2018 and 2021.

Fill out the form below to receive our driver-focused communications and to receive information about best-in-class professional driving jobs.

On the first Thursday of every month, NTI President & CEO Leah Shaver, aka the Sunshine Girl, goes live on air on SiriusXM Channel 146, Road Dog Trucking, to talk with drivers about all things pay. From paycheck questions to working with fleets on resolving issues around compensation, HR and legal, life on the road, and relationships with their employers, Payday on Road Dog Live dives into topics drivers care about most.

Catch every episode live on SiriusXM, SiriusXM.com, or the SiriusXM app, where you can also listen to episodes on demand.