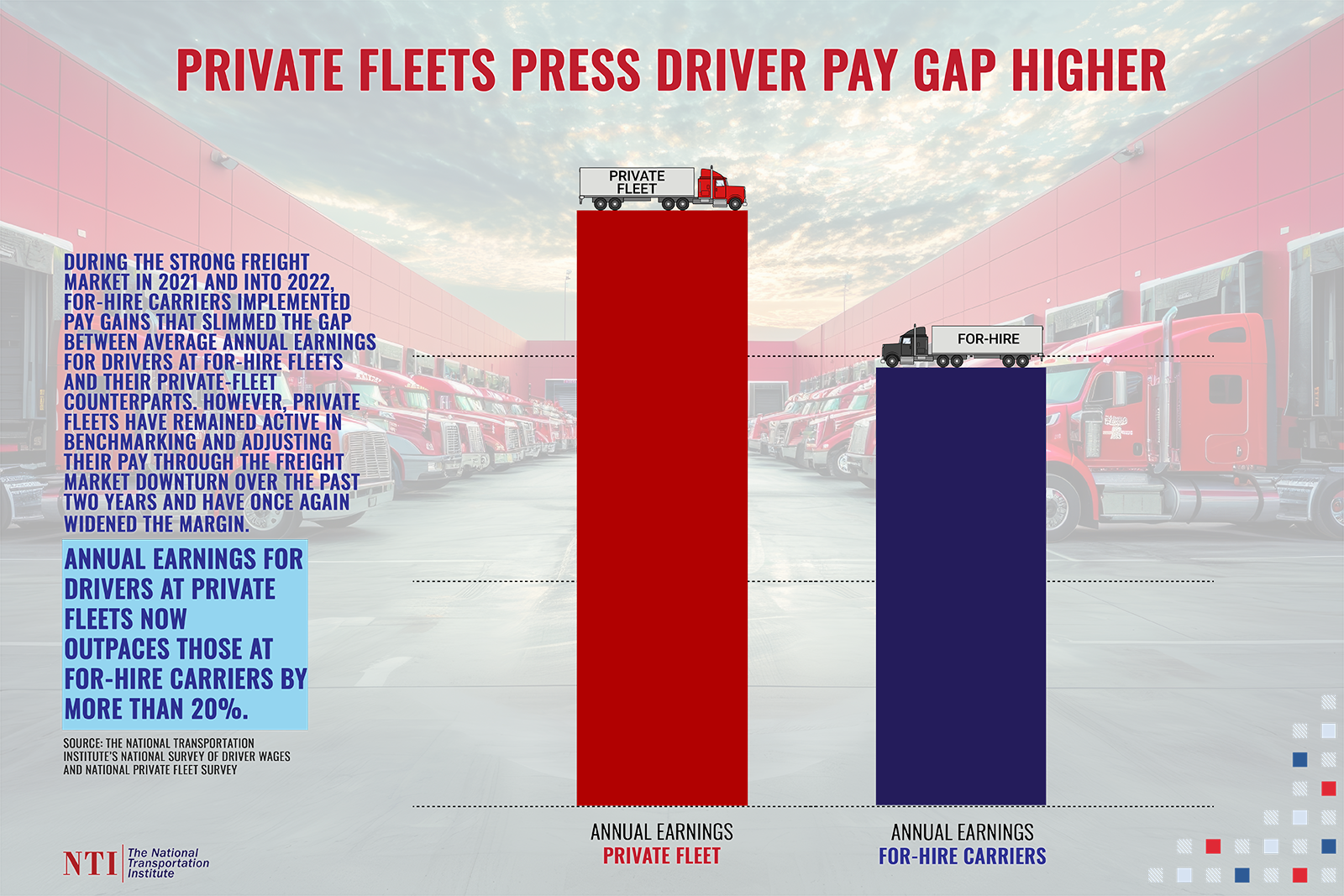

“Understanding how to articulate your pay, making a plan for messaging your pay, and being consistent in how you deliver your pay is just as important as the amount you pay,” writes NTI’s Leah Shaver in a column for FleetOwner. Read it here.

As uncertainty lurks, driver pay has seemingly entered a new cycle

Beginning in the late summer and continuing through the fall and winter, though, the holding pattern broke, and data from